According to the Federal Reserve, the total amount of household debt in the U.S. reached $15.24 trillion.

How big of a check do you think you would need to pay the balance of $15,240,000,000,000?

Luckily, that’s the total amount of debt for every household…so it doesn’t all fall on you (whew). To get the average amount of debt, you take $15.24 trillion and divide it by the total number of U.S. households. At the time of writing, United States Census Bureau states that there are 120,756,048 total U.S. households (very specific).

So, the average amount of household debt in the U.S. is $126,204.86 based on those two giant numbers.

Although that average number is a lot more palatable, it’s still not affordable for most people (unless you’re Jeff Bezos). You see, almost 70% of Americans have less than $1,000 in their savings account.

I didn’t bring that statistic up not to shame the individuals who don’t have a lot of money saved up. That would be rude. Instead, I’m merely using it to further paint the debt picture.

Maybe the reason why most Americans don’t have much savings is due to the fact that most of their money already goes toward paying off their debt.

Although that could be the case, all of this racked-up debt is also what fuels the collections industry. The debt collection industry is worth a whopping $18.8 billion.

The point I’m trying to make with all of this is that it’s inevitable for organizations to run into clients who don’t pay off what they owe.

When those outstanding balances arise, it falls on the organization to try to collect on that debt…which could sometimes be more expensive than what’s owed.

But collecting from your clients doesn’t have to be an expensive, painstaking process. Sometimes, all that’s required is to send a solid debt collection letter. Of course, the next question is, “How do I write an effective debt collection letter?”

Table of Contents

Step 1: Understand Legal Restrictions

When most people hear the word “debt collections”, they think of famous movie scenes involving loan sharks like in the famous Mean Streets scene.

The bottom line (pun intended) is that telling people that they owe you money and asking them to pay it on the spot isn’t a pleasant process…it’s sensitive in nature. You, as the organization, need revenue in order to keep your lights on. Meanwhile, your clients who have outstanding balances with you might’ve recently fallen into recent financial hardship.

Due to the sensitive nature of the collections process, the government passed the Fair Debt Collection Practices Act (FDCA) to protect individuals who owe a debt.

Coincidentally enough, Mean Streets (1973) came out 4 years before FDCA (1977) became a law. So, maybe the debt collection practices that Mike (Richard Romanus) used on Johnny Boy (Robert De Niro) weren’t against the law at that time. I’m being facetious.

Anyway, FDCA exists to limit the actions of third-party debt collectors. It doesn’t affect organizations that provide a product or service that’s beyond debt collection.

For example, if you forgot your wallet at your local department store one day and the owner let you “buy” the item with an IOU, that’s outside of FDCA. FDCA only pertains to organizations whose sole purpose is to collect debts.

That last statement is either good news or bad news depending on which side of the collection coin you fall on.

FDCA covers specific requirements. Debt collectors…

Can’t contact debtors at inconvenient times unless they’re told by the debtor that it’s OK.

May send letters, emails and/or text messages to collect a debt

Can attempt to reach debtors at home or work

Cannot contact debtors at their place of work if requested not to

Must provide a validation notice within 5 days of contacting a debtor

Of course, there is more to the law than those five requirements…but for the blog post you get the idea.

Whether you’re the owner of what FDCA considers a third-party debt collector or a business owner, it’s important to understand the legal requirements surrounding collections before you do anything else.

Step 2: Know What to Include

The most important aspect to keep in mind while you’re writing your effective debt collection letter is the content that you include.

At this point in the process, you’ve probably already sent past due and dunning letters, which might make this section seem obvious. But, there is some minutiae involved in drafting your letter than including how much money the debtor owes you and calling it a day.

The ultimate goal of your collection letter is…to collect. But, that’s a lot easier than it sounds.

You see, you also need to cover certain topics like information about your organization and why you sent the debtor the letter.

More specifically, you need to include…

An Identifying Subheading: Your subheading should include identification information including company name, logo, mailing address, phone number and date.

Address The Problem: In order for the debtor to agree that they have an outstanding balance with you, you need to address the problem. Explain why you’ve reached out to them and, most importantly, include proof regarding the debt in question. This is also the appropriate place to refer back to any contracts or agreements in place.

Debt Amount Details: The main reason why you sent the letter in the first place. Include the dollar amount of the debt owed, the original due, interest gained and/or additional fees accrued. Sometimes there might be multiple sub-accounts or amounts involved with a debtor, don’t forget to include those as well.

Context: Explain additional steps that the debtor could take to help alleviate what they owe you. If you’re allowing a minimum payment amount or installments, you need to make sure that it exists within your letter.

Deadline: Clearly state the new due date of the outstanding balance and/or when you expect to hear back from the debtor.

Call-to-Action: Let the debtor know what happens if you don’t receive a payment or response by the deadline. Stay professional but state consequences.

By the time you’ve added all of those specific sections, you’ll have an effective debt collection letter.

The only other aspect you’ll have to pay close attention to is the language you use.

Step 3: Watch Your Language

The language you use throughout the debt collection letters you send is the second most important aspect.

If you add all of the sections and information that I laid out in the previous section of this blog post only to include threatening and aggressive language, you’re not going to see much success.

You see, the data points you include are only half of the debt collection letter puzzle piece.

You have to also motivate your client who hasn’t paid you to satisfy their debt with you. The moment you use aggressive language, that chance to motivate goes out the window.

So what should you do instead?

Use professional language: That means using phrases like “please” and “thank you”. You can still emphasize the urgency of the situation, but don’t overdo it. Use clear and direct language so that there isn’t any room for misinterpretation.

Be Specific: Include evidence and refer to your original agreement. You want to include as much important data as possible that reinforces your claims.

Keep Everything: If things were ever to escalate past this point, you don’t want it to be a battle of your word against the debtors. You need to keep a record of every correspondence that you’ve sent regarding the debtor’s overdue balance.

Framing your debt collection letter is finicky, but the language you use is the difference between no response and a paid balance.

Step 4: Create a Template

It would be great if you only had to write and send out a debt collection letter once every few months or so. But, that's not realistic.

Unfortunately, outstanding balances aren’t uncommon. Depending on which vertical your organization is in, they could be an everyday occurrence.

Over 65% of all U.S. bankruptcies are due to medical debt (AJPH)

The average debt per 2021 college student upon graduation was $31,100 (Education Data Initiative)

The average American mortgage loan debt was $208,185 in 2020 (Experian)

Almost 10% of outstanding auto loan debt is at least 90 days late (LendingTree)

With just four statistics, you can see how debt collection is standard practice across multiple industries.

Since that’s the case, it means that it’s also a bit of a time sink. If you had an entire internal team devoted to attempting to collect on debtors, it wouldn’t be that big of a deal. But most organizations don’t.

If you fall on that spectrum it means that you have a group of people or one individual who wears multiple hats.

In other words, they have other daily responsibilities to attend to on top of trying to motivate outstanding accounts to pay. To streamline this added responsibility, you’ll need to create a debt collection letter template.

Once you have the language of your letter down, the only parts of it that need to change are the data points and evidence. Everything else can stay the same.

So send out a few different debt collection letters to your first few debtors. Turn whichever one sees the highest success rate into a template.

Step 5: Use Innovative Alternatives

Sending a letter in the mail is a tried and true method to collecting outstanding debt.

In most cases, you’ll stuff the letter in a standard 4 1/8″ by 9 1/2″ envelope, stamp it and mail it…easy enough.

But there’s one main problem with using the standard letter and envelope method. American households receive 940 pieces of mail per year.

Based on that statistic, what are the chances that your client sees the 1 standard-sized debt collection letter that you sent to their house? Less than 1%.

I know what you’re thinking, “After going through all of this detail about explaining how to write an effective debt collection letter, is this guy really trying to talk me out of it?”

No. I’m simply leading up to the point of this section, the mailing alternatives that exist.

Out of everything that exists, though, the most effective debt collection mailing alternative is postcards.

Yes, you read that right.

I’m not talking about the type of postcards that your neighbors send you while they’re on vacation to make you jealous.

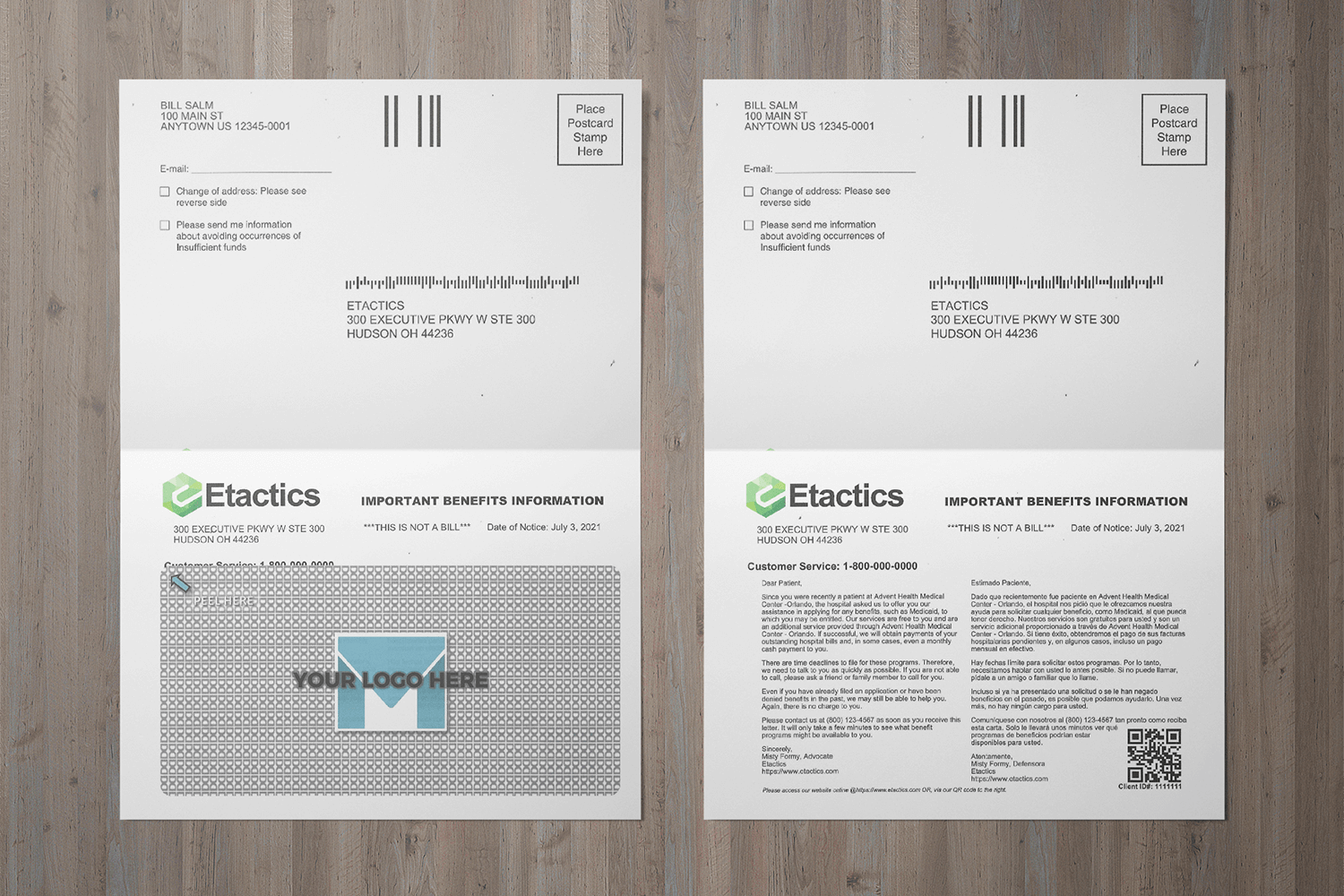

I’m talking about a debt collection letter that’s designed inside of a 4” by 6” postcard. It might sound silly, but there’s evidence of these working.

53% of recipients claim they read mail sent in a postcard format. The same source (DMA) also concluded that postcards see the highest response rate of any direct mail format with 4.5%.

So, should you run to the post office and buy a bunch of postcards that say “Wish you were here.” on them then disguise them as collection letters with what you write on the back? No.

You should contact a direct mailing solution provider who can do this for you. We have a debt collection letter postcard solution that we call Secure Card™.

It not only stays in line with the success rate statistics that I just provided but also keeps the sensitive information protected with a peel-away protected sticker.

Conclusion

By the end of this blog post, you know the key data points you need to include in your debt collection letter, the type of language you should use, how to create a reusable template and innovative mailing alternatives that exist.

In other words, you’re well-equipped to take on the responsibility of motivating your debtors to satisfy the balance that they owe you.

Whether you’re a third-party agency whose sole purpose is collections or an organization with a lot of clients who have outstanding balances, knowing how to write an effective debt collection letter is an essential business practice.