In 2017, an American Medical Association (AMA) found that healthcare facilities spend two days every week working through prior authorization (PA) requirements on average.

Based on the current rate of burnout within healthcare, that’s way too much time spent on dealing with insurance organizations.

The solution is simple, right? Figure out a way to make this weekly workload easier by streamlining processes. It’s not that easy.

Insurances continue to expand their prior authorization requirements, making the process even more labor some.

In fact, the process has gotten so laborious that sometimes it makes more sense to submit a claim without prior authorization to save time. That way the insurance organization receives the claim within its timely filing limit.

Sure, doing that strategy 100% guarantees that the submitted claim will come back as a denial. The way that medical billers view prior authorization denials is that it’s easier to overturn than a denial for missing a timely filing deadline.

If you don’t do that strategy, it’s worth considering…but explaining its intricacies and benefits goes beyond the scope of this blog post.

You’re going to receive prior authorization denials whether you anticipate them as a part of your claim submission strategy or not.

What matters most is what you do after you receive them.

You have two options when these claims come back to you with a denied status. You could either write them off as a loss or request an appeal from the insurance company.

Writing denials off is the easy route and it’s something you’re going to have to get used to. Some denials just can’t get overturned, no matter how hard you try…lucky prior authorization doesn’t fall into that category.

However, doing so impacts your organization’s revenue so it’s not the route you want to take often. Although it takes a little bit of effort, appealing your prior authorization denials is the best strategy.

The “little bit of effort” I’m referring to is writing and sending an appeal letter for your prior authorization denials. Luckily, you can streamline this process. All you need are a few effective templates to help.

Here are 3 powerful prior authorization denial sample appeal letters.

Table of Contents

How Does a Prior Authorization Denial Happen?

Before giving you all of my secrets (they’re coming, don’t worry), I need to explain how you appeal a prior authorization denial. In order to understand how to do that, we need to understand why they happen.

The truth is…insurance companies are out to get you. They don’t care one way or another, they deny your claims on a whim because they feel like it. I’m kidding (mostly).

In a perfect world, practices care for patients, patients have health insurance and health insurances pay practices for the services they rendered.

If you’ve worked in healthcare for a while now, you know that that’s not the case.

You see, prior authorization is one of the first steps that should occur before a medical professional provides or performs a service on a patient. To be more specific, before any servicing happens, a doctor needs to ensure that a patient’s insurance provider will pay for it. Prior authorization also applies to prescriptions in most cases.

In most cases, prior authorization happens by either calling a payer or contacting it electronically.

The screenshot above comes from Healthcare Partners. It has an entire section of its website devoted to explaining its prior authorization process. It confirms the point from earlier, in most cases, PA happens by speaking with a representative of a provider or electronically.

Prior authorization is a step that happens ideally before a patient receives any form of treatment…that way there wouldn’t be any denials.

However, the reality of it is much different.

If you scrolled down from the page that the previous screenshot was on, you should stumble upon this section of Healthcare Partners’ webpage.

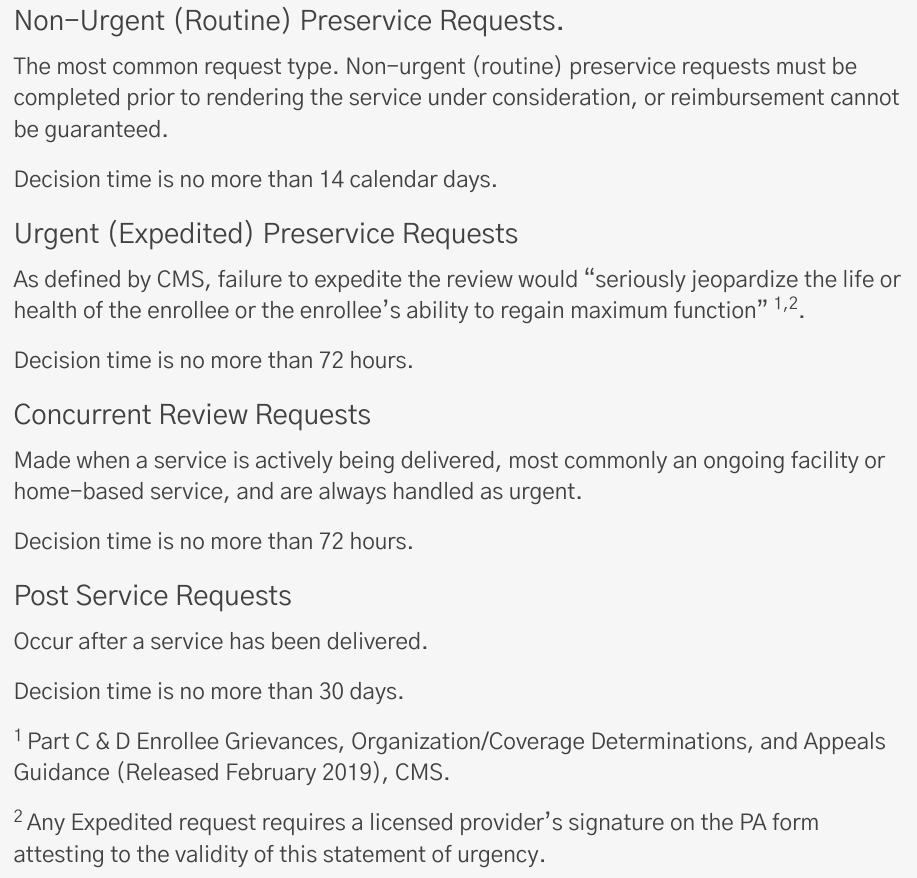

You see, payers place time requirements on prior authorizations. In this case, for routine procedures, Healthcare Partners requires authorization for services within 14 days of services rendered.

That deadline isn’t unique to Healthcare Partners, many other healthcare insurances also use 14 days.

Sometimes insurance payers provide their exhaustive list of PA services, prescriptions, etc. online like with the example screenshot above from Paramount Healthcare. Paramount Healthcare’s PA document is a 14-page long table with what seems like thousands of rows.

After all of this, the question still remains, “How do prior authorization denials happen?”

Well, there are a lot of different logistical reasons why doctors run into this issue so often…the sample letters provided within the rest of this blog post will help you. But, prior authorization denials happen when the provider doesn’t have PA from the patient’s insurance organization.

Appeal Letter Sample 1: Backdate Request

If you receive a PA denial, it’s not the end of the world. It’s mostly a minor convenience.

You see, in many cases, you can request that the payer backdate prior authorization. This is the main reason why I mentioned in the introduction of this blog post the strategy where medical billers submit claims knowing that they’ll come back as a PA denial.

The best way to approach a backdate request for a PA denial isn’t usually through a strongly worded email or a letter that’s reflective of your organization. You should call the payer.

Team Member: Good morning, this is Joseph from Healthcare ABC’s office. I'm calling regarding our a claim that was recently denied.

Insurance Rep: OK, do you have the claim number?

Team Member: Yes, the claim number is 123456

Insurance Rep: I've pulled it up on my end. It seems the reason for the claim denial is "Prior Authorization".

Team Member: Correct. Is there any way we could backdate the prior authorization of the service? We're authorized now.

Insurance Rep: Yes, we can do that. Please resubmit this claim with it's new authorization number - 567819.

That’s why this first “appeal letter sample” isn’t really a letter at all. Instead, it’s a phone script.

Yes, calling an insurance organization means navigating through automated systems and hold times. But, asking for a backdate request is a lot easier when talking to a representative than communicating the same via a physical letter.

Making this request is usually successful. If it is and the insurance organization will accept your claim, resubmit it with a note that includes the new authorization number.

You don’t want to go through all of this trouble for nothing, which is why it’s so important to include the new number attached to your resubmission.

Appeal Letter Sample 2: Retroactive Authorization

In some healthcare settings, medical professionals don’t have time to wait on an insurance organization.

For example, if a patient is in a hospital setting and needs emergency surgery…the medical staff can’t wait around for the acceptance of their prior authorization request.

Yes, the screenshot from Healthcare Partners earlier had a section that mentioned “Urgent” prior authorizations. Even so, the decision time was 72 hours. No emergency can wait 72 hours.

Enter the retroactive authorization.

This is a special type of PA where the requests for approval come after the fact. Insurance organizations only accept retroactive authorizations if they meet extenuating circumstances. Usually, those “circumstances” exist within the insurance provider manual.

Since insurances put up another guardrail associated with this type of PA, you’ll likely receive a denial from it at some point.

When this happens, find the section about extenuating circumstances within the provider manual of the insurance that denied your claim.

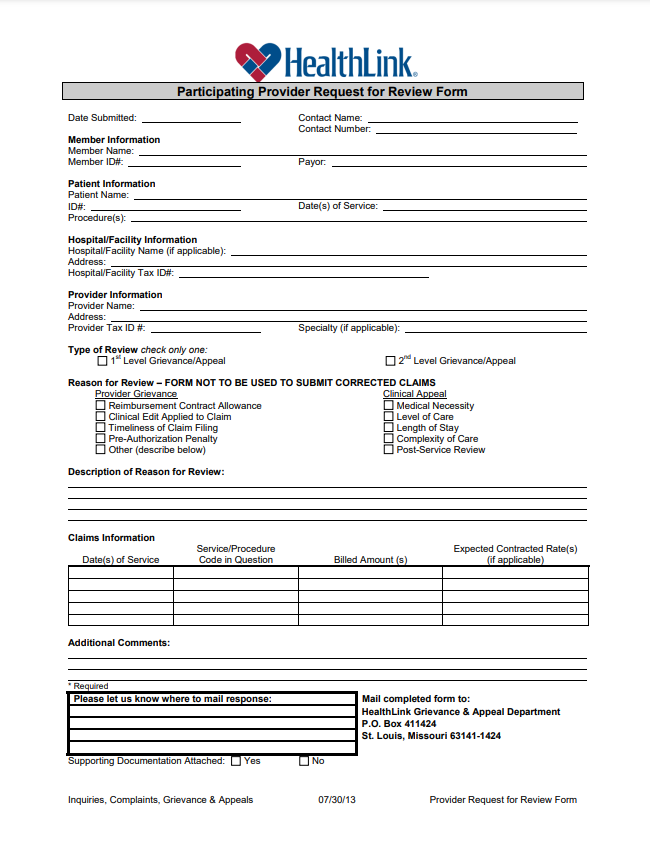

The image above comes from the requirements listed within HealthLink’s “administrative manual”.

It mentions that providers must include documentation about extenuating circumstances and submit a request via the Participating Provider Request for Review Form.

Above is a screenshot of HealthLink’s Participating Provider Request for Review Form.

This is the next sample appeal letter for prior authorization. It’s also not a letter, either. You see, you’re going to have some scenarios where insurance organizations require you to fill out their form.

This happens more often than you might think, especially if you have an emergency services department.

Appeal Letter Sample 3: Requirements Changed

Out of all of the different prior authorization denial scenarios I’ve gone over so far, by far the most frustrating one is when requirements change and you weren’t notified.

You see, the PA requirements that insurance organizations have aren’t stagnant…they change.

In a perfect world, the insurance organization changes its requirements and you receive a notification about it. But, that’s not the case.

The reality is that many medical facilities receive PA denials because the insurance they submitted claims to changed what services they accept.

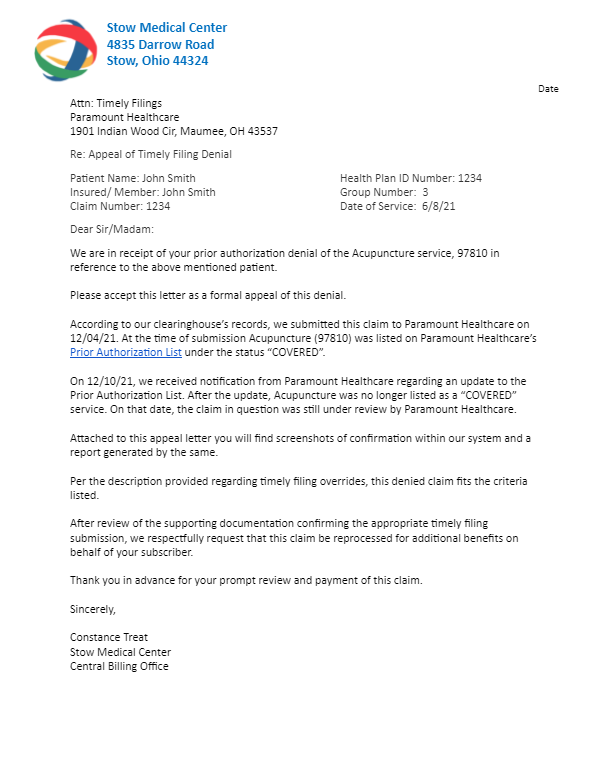

Although annoying, this type of prior authorization denial is fairly easy to appeal…it just requires evidence from your end.

Remember that 14 page table from Paramount Healthcare? At the top of that table (screenshot above), there was a “last updated” date listed in bold, red letters.

If you were to submit a claim to Paramount Healthcare for a service that it used to provide prior authorization for, it would come back as a denial.

So what should you do?

This is where you write and submit an appeal letter.

In that letter, describe what happened. It’s possible that the insurance changed its PA requirements while your claim was processing. In that case, provide screenshots and/or reports generated by your clearinghouse.

Maybe the insurance organization did send you notification of the PA changes it made…but you didn’t receive it until after you submitted the claim.

Include a screenshot of the date of that notification alongside the date you submitted the claim.

Providing as much evidence as possible alongside a formally written appeal letter almost guarantees the insurance organization will have no choice but to compensate you for that denial.

Conclusion

If you’ve worked within the medical billing space for some time now, you understand that some claim denials are impossible to overturn.

Luckily, prior authorization denials don’t fall under that category. I mean, there’s a reason why I mentioned that some medical billers submit claims without PA in the introduction.

To overturn PA denials, it’s more so a matter of understanding the insurance organization’s requirements.

Once you figure out what kind of prior authorization denial you received, you can use this blog post to help you find the perfect sample appeal letter and receive what’s owed to you.