Nearly half of all parents plan on enrolling their kids into some type of child care, camp, or program during the summer.

In general, US families spend $8,355 on average on child care every year per kid.

If you’re an owner or manager of an organization that provides child care, those two statistics are good news. They both point to the fact that the services you offer are in demand.

From your clients’ perspective, though, it means that they essentially have to pay an extra mortgage payment every month.

That means that there’s a good chance that your clients could incur more debt. To be more specific, 40% of parents admit to going into debt due to the cost of child care.

38% of parents have had to take on a second job or side hustle to afford the costs of child care.

The point I’m trying to make is that your organization exists to make your clients’ lives easier. Why can’t that philosophy extend into billing?

Now, I’m not trying to convince you to lower the price associated with the services that your organization provides. That’s not realistic.

Instead, offering a streamlined and modern approach to billing your clients will make managing the costs associated with your organization easier.

A “streamlined and modern” approach to billing starts with the invoices you send to your clients.

Here are 5 effective child care invoice templates that will increase your revenue.

Table of Contents

Template 1: Take Advantage of Envelope Windows

What you send your clients through the mail matters.

American households receive over 450 physical pieces of advertising through the mail every year.

Thus, your clients’ mailboxes are already stuffed with pieces of paper screaming for just a few seconds of their attention as they sort through them.

Yes, what you sent to your clients is more important than advertising. But, they aren’t going to know that just by taking a glimpse at their daily pile of mail.

How do you stand out in these stuffed mailboxes?

It all comes down to the design of the invoices you send. But it isn’t just what’s inside the envelopes you send that matters.

Typically, invoices get sent through a double-windowed #10 envelopes.

The top window includes information about where the mail came from. The bottom contains information for the mail carrier to figure out to who to send the envelope.

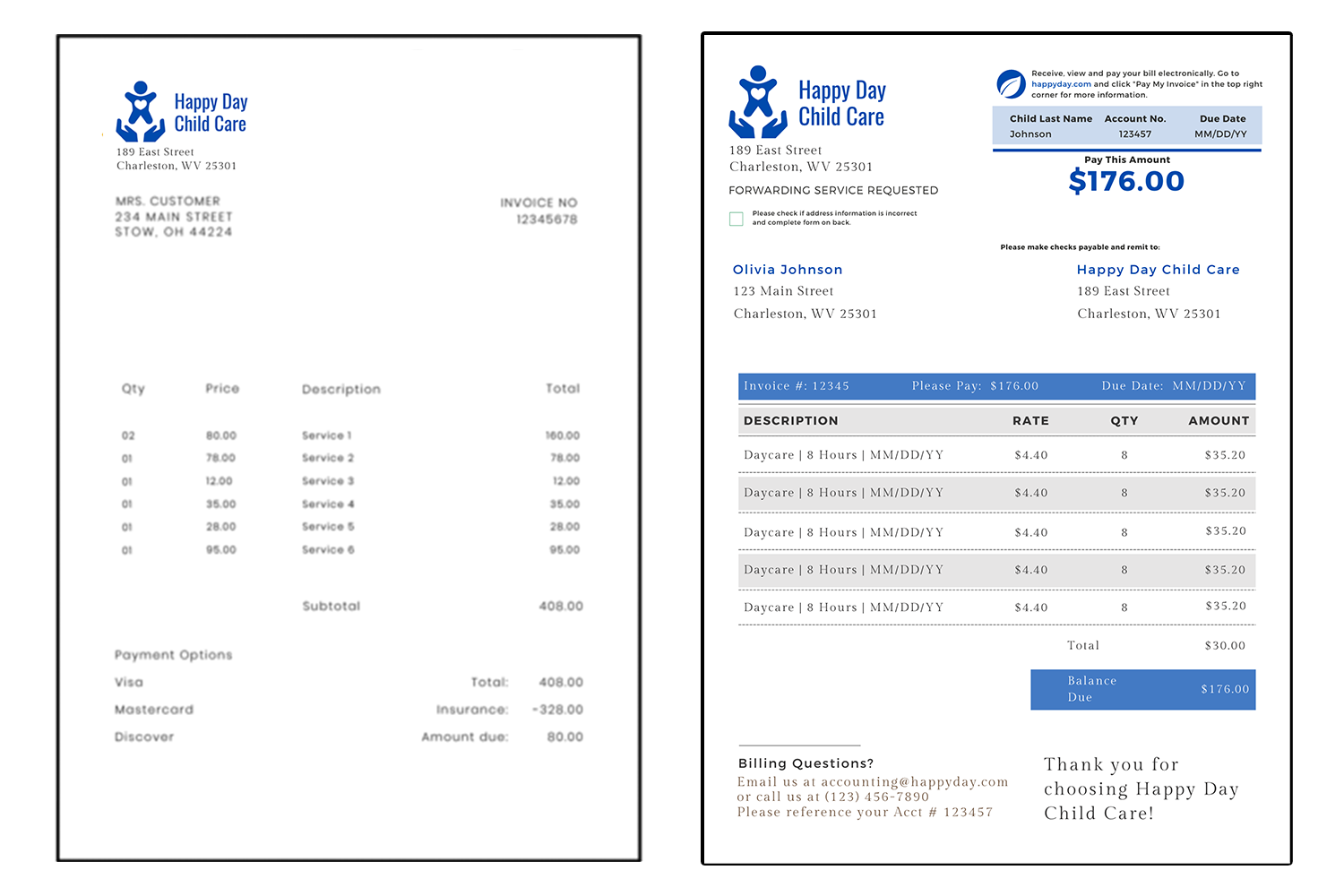

The image above is two examples of the same sample invoice envelopes from a child care center. You don’t have to look at the image for very long to notice the difference, but I need to break it down anyway.

Both images include the proper address information contained within a #10 envelope’s windows.

The difference between the two is one contains the organization’s logo in full color and the other takes a more standardized approach.

Which of the two examples do you think would have a higher chance of getting noticed and opened by your clients? The answer to that question is easy…the bottom one.

Since your clients are already getting inundated with physical mail, you want to take advantage of anything that could help your invoice stand out from the pile. Thus, little details like envelope windows matter.

Template 2: Designed for Readability

Alright, so let’s say that you took advantage of envelope windows, you got your clients’ attention and they opened your invoice.

Nothing else matters, right? They know that what they received from you is an invoice and they’ll pay it immediately.

Not so fast.

Of course, we have to bring up some examples for comparison’s sake.

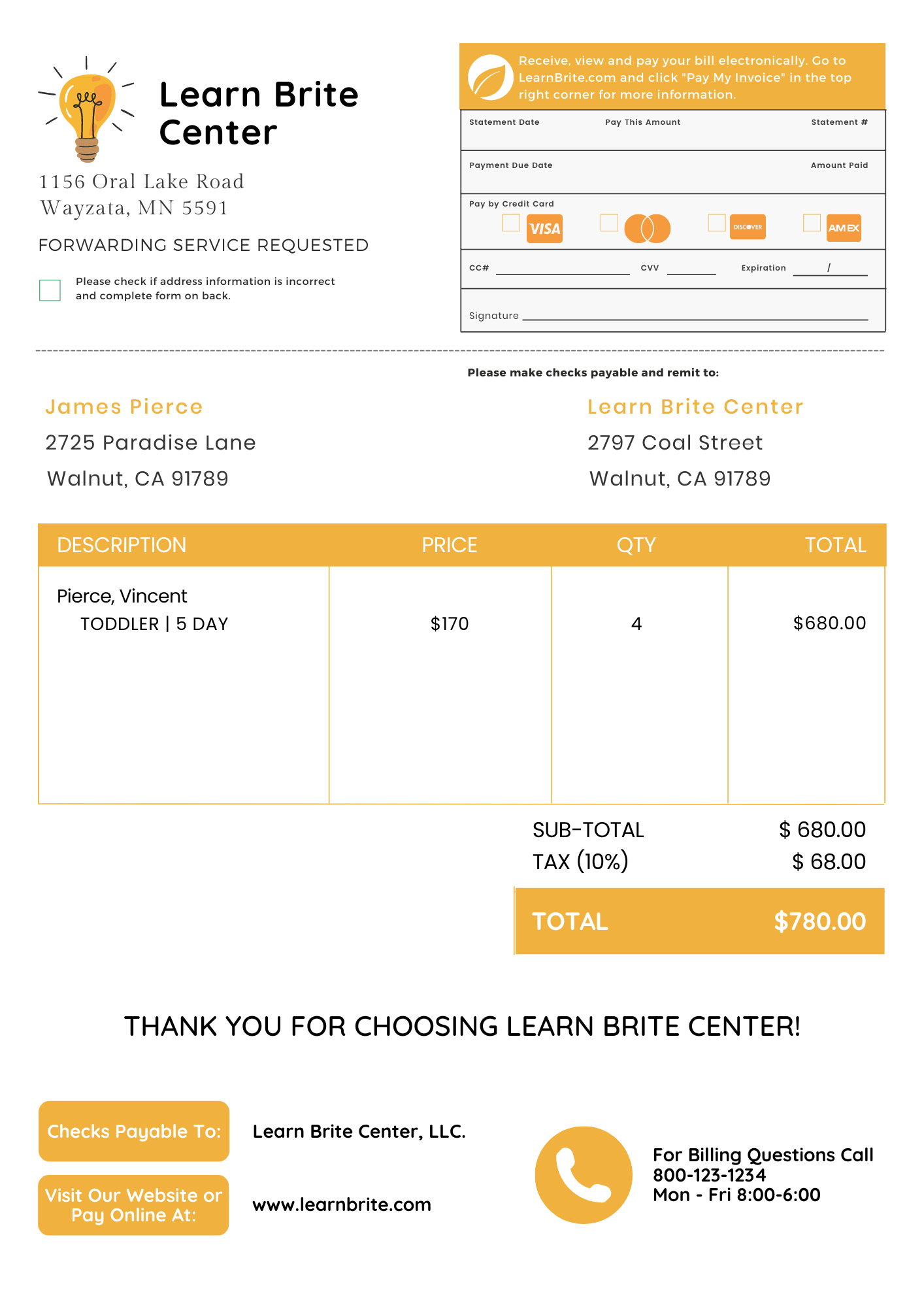

The two invoice examples in the image above tell two different stories.

If your client received an invoice that looked like the example on the left, they’re going to have a hard time staying focused and understanding. Sure, it’s an itemized list and they might figure out how much they owe you. But, they’re not going to know how to pay you.

Meanwhile, the invoice on the right keeps design concepts in mind that help your clients follow a visual hierarchy. It’s a lot easier to understand. More importantly, it provides step-by-step payment instructions on it (more on that later).

It’s not just what your invoice looks like on the outside that matters, how it looks on the inside is also important.

Template 3: Use Remits

Checks only account for 7% of all transactions. To pile on, only 56% of people say that they’ve written at least one check in the last month. That’s not promising.

How are you supposed to collect from your clients if they don’t write checks? What happens if they don’t even use them?

The answer is easier than you think. Utilize prepaid envelopes and remits.

A remit in the invoicing world is a portion of the bill that’s perforated for easy tearing. How does it help solve the client who doesn’t have a check problem?

Remits allow your clients to fill in necessary payment information for you to process. They ask for your clients’ payment amount, credit card information and authorizing signature all on the statement that you send.

Once filled out the form gets filled out, your client tears off the perforated edge, places it in the prepaid postage #9 envelope that was also included inside their invoice, and mail it back to you.

Remits also don’t take up too much space on the bills that you send to your clients. The example invoice above has what’s referred to as a “top remit” because the perforated edge exists at the top.

Checks aren’t required when your invoice includes a remit, which makes it easier for your clients to pay you.

Template 4: Dunning Messages

We’re really getting into the weeds here, I know. But all of these details matter when you’re trying to collect money from your clients.

The last thing you want to have to do is outsource a collections agency and send debt collection letters only to have to write the bad debt off as a loss at the end of the year.

So, what else is there?

Let’s get into dunning messages and letters.

“Dunning letter” is a term that’s used in the financing world. Basically, they’re letters that get sent out to clients as reminders about the status of their accounts.

Although it would be nice if all of your clients paid you the moment they received their invoice, that’s not realistic. Even worse, the truth is that you’re not going to receive all of the money that’s owed to you. Some of your clients aren’t going to satisfy their balance with you. The sooner you come to that realization, the better.

Anyway, the point I’m trying to make with all of this is that you’ll need to send dunning letters and reminders to clients who forgot about their bills.

In the invoicing world, “dunning messages” are an option as well. Instead of spending more money on ink and postage for an entirely new letter, sometimes it’s better to resend a client’s invoice and include a message within it about the status of their account.

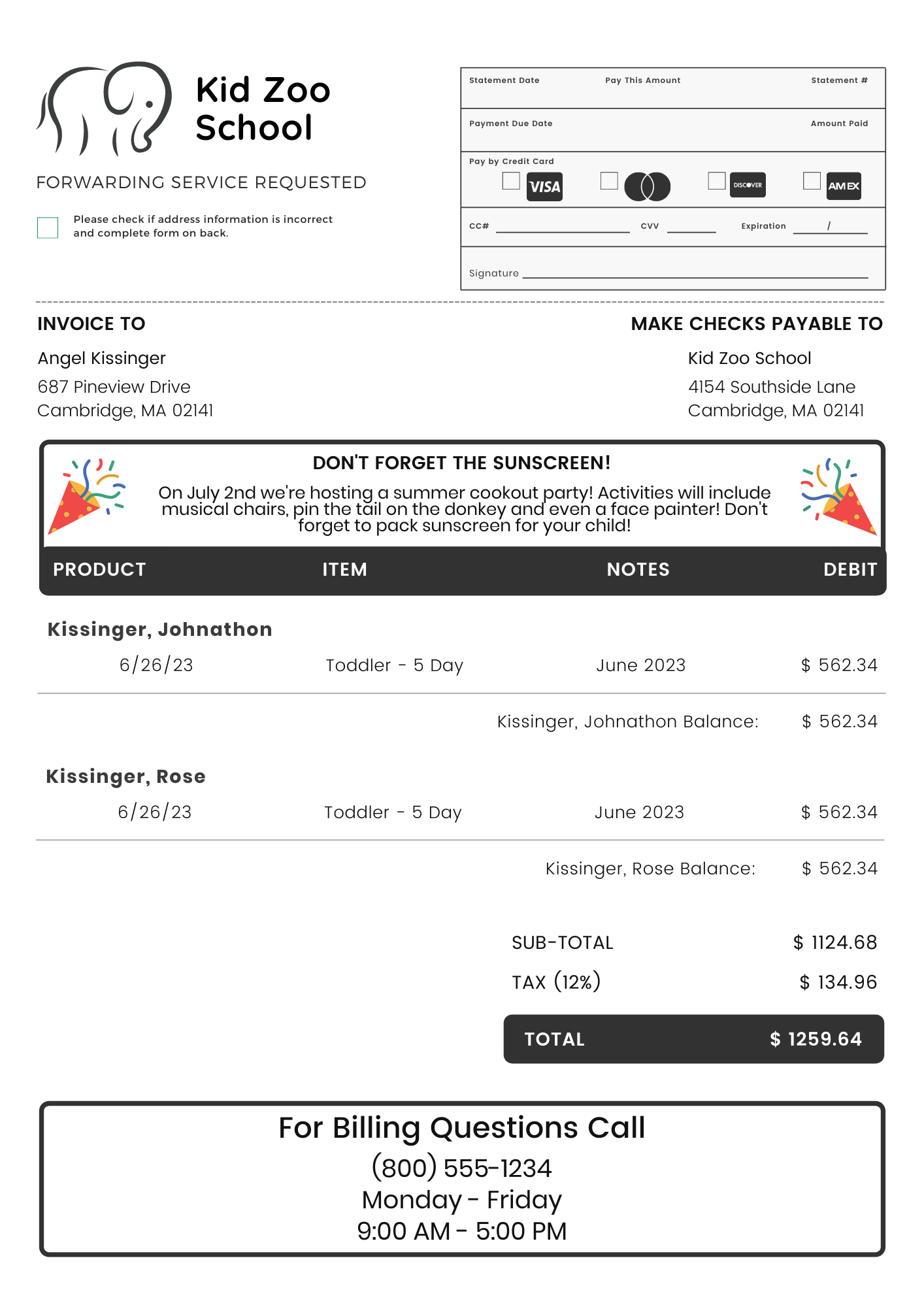

But dunning messages don’t always have to be specific to account status, either. You can use them as a mode to communicate specific messages to your clients. The example image above has a dunning message that alerts the parent about an upcoming event at the child care facility.

Dunning messages are a must-have aspect to include in your child care invoices. They help from a collection and marketing standpoint.

Template 5: Encourage Payment Plans

Do you remember in the introduction when I explained the average amount of money that US households spend on child care per kid? It wasn’t a small number.

Let’s compare numbers. The average I’m referring to from the introduction was $8,355. Meanwhile, the median amount of money that Americans have in their savings account is $5,300.

The point I’m trying to make with all of this is that you’re going to have a hard time collecting from a lot of your clients if the annual cost of your services is higher than what most people have readily in their bank accounts.

Again, I’m not saying that you need to decrease the costs of your services.

Instead, you need to come up with easier, more affordable ways for your clients to pay you.

Enter payment plans, stage left.

If your organization wasn’t within the child care space, it wouldn’t matter. You would still want to use payment plans.

You see, nearly 80% of consumers are more likely to buy something if what they’re shopping for offers a payment plan.

They make everything more affordable. Explaining how to set up a payment plan for your child care organization falls outside the scope of this blog post.

However, once you have it all figured out…why not use your invoices as a way to increase payment plan sign-ups?

This example is a bottom remit. It provides a step-by-step process for clients to either pay their bills or enroll in a payment plan. All they have to do is fill out the remit and mail it back to you.

Payment plans reduce bottlenecks in your cash flow by ensuring that your clients pay their balances to you on a regular basis.

Conclusion

Before you started reading this blog post, you probably didn’t think there was so much involved in properly invoicing your clients as a child care facility.

Sure, you could go to some random invoice generator online and download a template invoice from it. But invoices from those online generators aren’t going to contain as much attention to detail and it’s the detail that matters.

You see, the difference between an average invoice and an effective one that includes your branding, a remit, and a dunning message is the difference between getting ignored and paid.