If you mention the word “billing” to any mental professional, they’ll shutter. If they don’t it’s likely because they’re new to the industry.

Although the billing rules within the mental health space seem archaic, the practice sends shivers down the spine across the entire medical world…regardless of specialty.

You see, the average initial claim denial rate in Q3 of 2020 alone hit over 11%. At the time that was an all-time high and the survey that that statistic came from suggested that denial rates weren’t slowing down.

What I’m trying to convey is that you’re not the only healthcare professional who’s faced with the challenge of getting paid by client insurance providers.

That’s not to dismiss what you’re going through, misery loves company. But how do you actually solve this problem?

After all, there are differences between the types of claims that hospitals submit compared to those coming from mental health facilities.

Fair warning, I’m about to bring in another general statistic to help paint the healthcare billing landscape. A more recent survey from 2021 determined that 85% of denials are preventable.

In other words, if you’re wondering if there are ways to improve your billing processes and increase the revenue for your mental health organization, there’s hope.

That’s great news but what do you do and where should you start?

Well, as I alluded to earlier, the claims that come from hospital visits differ from those in the behavioral health world.

So maybe the reason why many behavioral health organizations struggle with mental health billing isn’t that it’s impossible. Instead, its intricacies and proper processes aren’t laid out in a digestible manner.

Luckily, we’re going to learn together by breaking down the essentials of mental health billing in this definitive step-by-step guide.

Table of Contents

The A - Z: Mental Health Insurance Billing Terms

Before we go any further into what you need from your clients, how to file claims properly and how to submit appeals to your inevitable denials…we need to learn the terms thrown around in the mental health insurance billing world.

This isn’t one of those industries where you dive right into it and learn as you go. If you went this route it would take you a few years to get a grasp on all of the jargon. Not to mention the fact that mental health billing is a specific niche within the space.

Anyway, this section lists the industry terms used within mental health billing.

Appeal

Although troubling, receiving a denial from a payer for a claim you submitted isn’t the end of the world.

However, if you think that the claim is correct as it is, you can write a letter or fill out a specific payer form. Whether you send this to the payer by mail or upload it to their portal, this process of disputing a denial is called an appeal.

ANSI-837

The acronym ANSI stands for the American National Standards Institute. ANSI 837 is the accepted, HIPAA-compliant electronic format for submitting mental health claims.

ANSI-837I

ANSI 837I is the accepted electronic format for facilities that have to use UB-04 claim submission forms.

The “I” stands for “Institutional”

ANSI-837P

ANSI 837P is the accepted electronic format for practices that have to submit under the CMS1500 form.

The “P” stands for “Professional”.

Claim Denial

Every insurance payer has a series of requirements required to receive reimbursement for claims.

If you submit a claim and it doesn’t meet all of the requirements, the payer won’t accept it and deny it. Usually, you receive a notification of the claim denial through your practice management (PM) system and your clearinghouse.

Clearinghouse

A clearinghouse is usually a service offered by a third-party organization that acts as a central repository and middle-man to your claim submission process.

Essentially, you submit your claims to a clearinghouse, it runs your submission through a series of automated tests and alerts you to any errors. It also usually has a series of pre-established connections to insurance organizations to streamline submission.

Clearinghouse Rejection

Before submitting your claim to a payer, you may submit it to your clearinghouse for review. If your clearinghouse finds an error, it will reject it and notify you of the same.

A clearinghouse rejection happens on a preliminary level. In other words, it’s like a second set of eyes reviewing your claims before you submit them so that you don’t receive a denial.

Rejections are better to receive than denials because they happen sooner and don’t affect your bottom line nearly as much.

Claim Submission

The process of submitting your client claims to your clearinghouse and/or insurance payer.

There are two industry-standard forms that payers accept in the mental health world if you print and mail a claim or upload that claim to the payer website; CMS1500 and UB-04.

If you submit electronically, claims can ben in an 837P or 837I ANSI format.

The type of form you’re required to submit to the payers you work with depends on what type of behavioral health organization you work for.

Claim Scrubbing

The process your clearinghouse runs your submitted claim through before sending it to the payer.

This process is usually automated. It involves checking for and correcting spelling and formatting errors.

Once scrubbed, your claim is ready for submission to a payer for reimbursement.

CMS 1500 Form

The Center of Medicaid and Medicare Services (CMS) 1500 form is the standard paper form that mental health practices must use to submit claims.

All professional claims must sent by paper use CMS 1500 forms. They’re also sometimes referred to as HCFA-1500.

Current Procedural Terminology (CPT)

CPT codes communicate services and tasks performed by mental health professionals during sessions.

They’re a 5-digit code that the Department of Health and Human Services (HHS) created to instill uniformity.

Insurance organizations refer to this code for billing purposes.

Denial Management

The process you establish within your organization, with the help from your clearinghouse. It involves reviewing and correcting claims that come back from payers with a denied status.

Electronic Admittance Advice (ERA)

If you’re enrolled with your payer to receive the status of the claims you submit through your clearinghouse or by other computerized means, you’re receiving electronic admittance advice (ERA).

You’ll receive this data whether or not the claims you submitted went through or came back as a denial.

Eligibility

If you have a client who comes in for an appointment for an ailment or service that isn’t covered by their insurance provider, you’re going to receive a denial on their claim that you submit.

Eligibility refers to the coverage associated with a payer’s plan.

Sometimes when eligibility responses come back it will explain what’s “in-network” and “out of network”.

If a client comes to you and the organization you work for isn’t contracting with their insurance provider, it’s referred to as an “out of network” visit.

Eligibility doesn’t say what providers are “in-network” and “out of network”. Thus, if you’re using an eligibility solution provider, you still need to determine that yourself using the information presented to you.

Explanation of Benefits (EOB)

If you aren’t enrolled to receive the status of your submitted claims electronically, you’ll receive an explanation of benefits (EOB) via the mail.

The EOB is the physical version of the ERA.

Managed Care Organization (MCO)

Medicaid enrollments hit over 76 million in 2021. In other words, it’s a massive healthcare payer.

To deal with the logistics associated with handling a patient ecosystem that large, Medicaid seeks outside help. First, the federal government provides money to states and US territories who manage the program.

Sometimes, these states run insurance program choose a handful of other payers to handle Medicaid claims.

As of 2019, there were 282 MCOs.

National Provider Identifier (NPI)

The Centers for Medicare and Medicaid Services (CMS) requires practically every mental health professional to have a National Provider Identifier (NPI) number. This is the result of an effort to add uniformity to healthcare reimbursements,

The professionals and/or organizations who need to have an NPI are those that meet the definition of a healthcare provider as described in 45 CFR 160.103.

Your NPI is a 10-digit number that’s used to identify you to other healthcare partners and payers.

Timely Filing Limit

A timely filing limit is one of the most common requirements placed on claim submissions. More specifically, it’s the amount of time a payer allows claim submission after rendered service.

If you submit a claim to a payer after the timely filing limit lapsed, you’ll receive a denial.

This requirement is different for every payer but the majority of them place it at 180 days.

UB-04 Form

UB-04 is the standard paper form for claim submissions that mental health institutions have to use.

This type of form replaced UB-92 forms in 2007 and it’s also sometimes referred to as CMS 1450.

Step 1: Information Collection

You can’t bill for your services without collecting information from your clients. That might sound like an obvious statement, but it’s trickier than it sounds.

What information do you need to collect from your mental health clients for billing purposes?

Required Provider Information

You need to be able to provide the following information on your end…

Provider Tax ID

Employment Identification Number (EIN) or Social Security Number (SSN)

Individual Provider NPI

Organizational Group NPI (lookup tool)

Provider License

Address (the address that’s on file with each insurance organization)

Required Patient Demographic Information

There are only 4 pieces of patient demographic information you need at a minimum for billing purposes

Full legal name

Date of birth

Address

Gender

Not Required Patient Demographic Information

The following patient demographic information isn’t required…

Social Security Number

Case Notes

Phone Number

Email Address

Although they aren’t required, some of the contact information listed above are good to capture, especially in the unfortunate event where client payments are past due (i.e. payment reminder emails).

Required Patient Insurance Information

Beyond demographic information, you gather the following patient insurance information…

Card Member or Subscriber ID

Group number

Authorization Number

Claims address

Mental Health/Behavioral health provider phone number (the eligibility one)

Although this isn’t a requirement, it’s not out of the ordinary and a best practice to photocopy the insurance cards of your clients and store them in a safe place.

Step 2: Information Verification and Eligibility

Gathering the information from your clients is only the first step, it’s also your responsibility to ensure that it’s accurate, up-to-date and eligible.

In a streamlined mental health organization, this process kicks off the moment the patient walks through the doors for their visit and continues through their appointment.

This is a key step in the process, verifying eligibility early helps stop this type of denials months before you would receive them.

Lucky, it’s a pretty straightforward process…you just need to know where to start.

Call the number that you recorded that was on the back of your client’s insurance card regarding eligibility.

Verify with the payer mental health outpatient provider eligibility and client benefits

Provide the payer with the provider information from step 1 (NPI, Provider Tax ID)

Ask if you’re “in-network”

Provide patient demographic and insurance information from step 2 (name, date of birth, subscriber ID)

Ask about deductible, copay and coinsurance and record the same

Ask how to bill claims online and for the payer ID and record the same

Ask for claims addresses as a backup

Ask about limits to visits and/or authorization requirements and record the same

Ask about “Routine Mental Health Outpatient Visits in an Office Setting”

Ask about the payer’s timely filing limit and record the same

Store your notes from the payer in a safe place that’s accessible

After this process, you have all of the information required to file claims, what to charge your client when they come in for a visit and how to file their claim via online or otherwise.

There are also many systems that can check eligibility on your behalf in a more efficient manner than making phone calls. This technology could be supplied by your EHR, clearinghouse, or a different third-party.

Step 3: CPT Code Recording

CPT codes are essential to billing. Without them, the payer wouldn’t be able to understand what happened during your client’s visit.

Recording them must happen right after the appointment occurs.

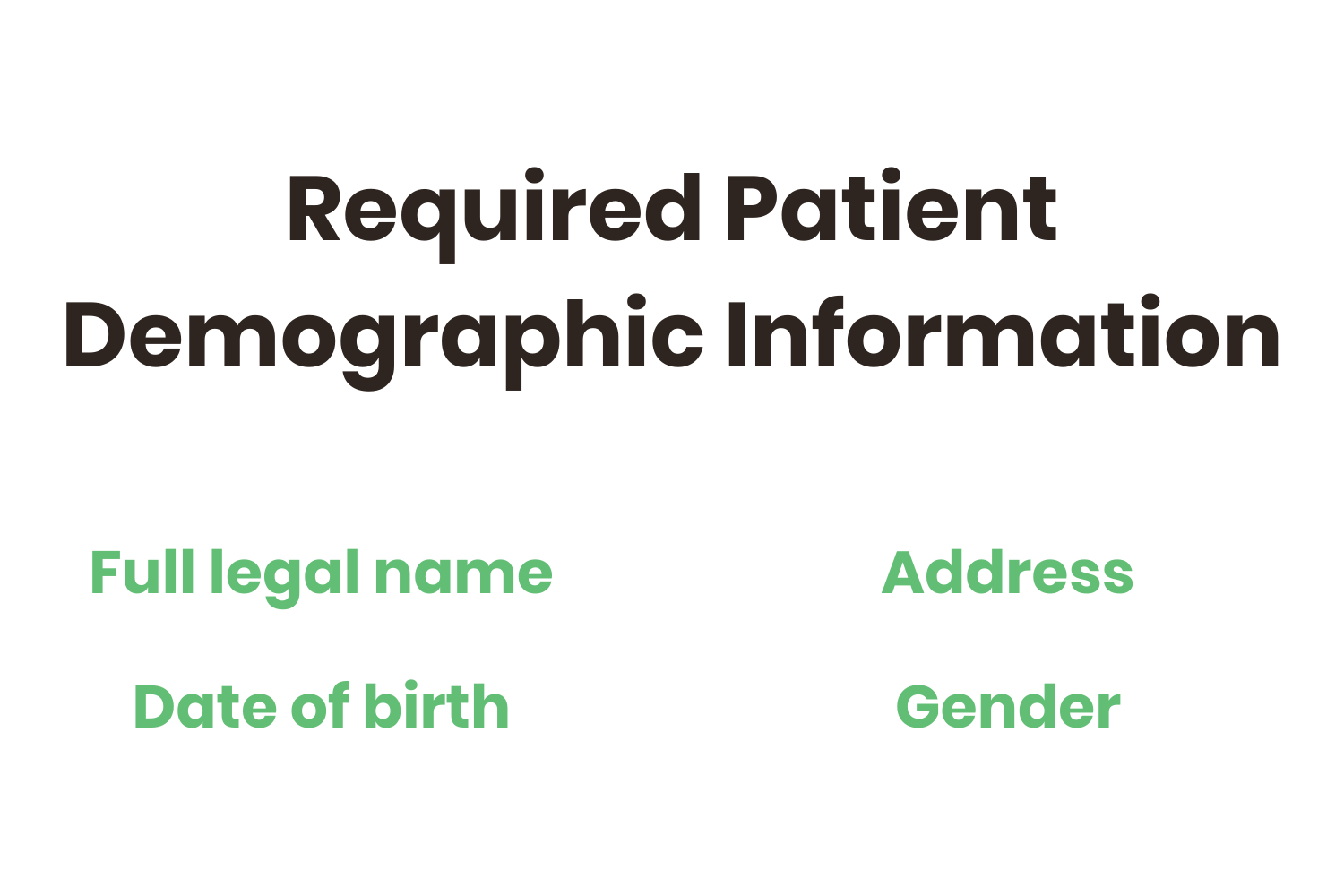

The four most common CPT codes are…

90791: Exclusive to the first appointment held with a client

90832: 16 - 37 minute session

90834: 38-52 minute session

90837: 53+ minute session

Although it seems straightforward, it’s worth mentioning that you bill for the first appointment first and then refer to the other codes based on session length.

Step 4: Claim Submission

This third step in the process is the granddaddy of them all. It’s likely the main reason why you clicked on this blog post in the first place.

There are a few different ways to submit claims to insurance payers. I’ll go into each of them in detail

Least Ideal: Mail Claims to Payers

In step 2 I mentioned that you ask payers for claims addresses. This is a backup step because the least ideal way to submit claims to payers is through the mail.

If you asked the USPS, they would tell you that first-class mail is one of the most secure ways to send anything sensitive. Although it’s the most tried and true method for claim submission, it adds another manual step to the process PLUS additional days for delivery.

To make this submission method even less appetizing, Medicare requires that mental health providers use electronic billing.

Somewhat Ideal: Payer Web Portals

OK, since Medicare made electronic mental health billing a requirement, how do you do this?

Remember in the definition of MCO where I mentioned that there were 282 of this type of organization in 2019? Well, each of those payers has a different web portal for claim submission.

The image above is a screenshot of Health First Colorado’s claim submission web portal.

It’s not bad, to be honest. If ALL of your patients had Health First Colorado as their payer, this wouldn’t be that bad of a manual process…but that’s not the case.

You see, every payer has a different web portal design and user experience.

So, although you’re technically submitting your claims electronically in this sense, it’s STILL a very manual process.

Unfortunately, it’s also the hardest part of the whole process. This is mostly because every payer has a different web portal to submit claims and they usually don’t provide the best user experience.

More Ideal: PM/EHR and Clearinghouse Integration

Since you and your staff work within your PM/EHR daily, the most ideal process to submit mental health claims to all of your client’s payers is through it.

You see, you need to find a clearinghouse that integrates with your PM/EHR system and vice versa.

That way, all you have to do is log back into your PM/EHR after the appointment, fill out the 1 form that your clearinghouse walks you through and submit it. From there, the clearinghouse automatically sends your client’s claim to their payer for billing purposes.

This is why it’s so important to choose a clearinghouse that has strong connections with payers and/or MCOs that are common in the mental health space.

Most Ideal: The Total Package

After all of this and even after Medicare’s electronic submission requirement, some payers STILL don’t have claim submission web portals.

These payers are in the minority but you don’t want to take any chances.

When these payers present themselves, it’s not the end of the world but it does present a process change. If your organization uses the “more ideal” claim submission process that I detailed above, these payers throw a wrench into things.

Luckily, this is another area where your clearinghouse can save the day. You see, some clearinghouses (like ours) can automatically accomplish multiple claim submission process alternatives exactly for this unique scenario.

That way, if a client comes through with a payer that only accepts paper claim submissions, you let the clearinghouse know and it will automatically generate and mail a CMS 1500 or UB-04 form.

Step 5: Clearinghouse Rejections

Before you “officially” send your claims to your client’s payers your clearinghouse should help you out via scrubbing and rejections. Both of those are processes that I alluded to in those term’s definitions but this is a good place to mention them again.

Your clearinghouse's sole purpose is to “have your back” when it comes to mental health billing.

That means it should be able to alert you of errors you make during the claim submission process and correct the same automatically.

This step happens simultaneously with step 4, but it needs mentioning because it’s another added benefit of choosing the “most ideal” alternative.

Step 6: Claims Processing and Feedback

Alright, by this step you’ve submitted a client claim. Congratulations, let’s break out the champagne and celebrate because we got through the hard part…right?

Unfortunately, now we need to figure out what happened to the claim and whether or not the payer accepted it.

Time to break down more alternatives to this step.

Least Ideal: Calling Payers

Remember way back in step 2 when I mentioned the phone call to the number on the back of your client’s insurance card? Seems like an eternity ago.

Well, in this alternative we have to call this number again and figure out the status of the claim you submitted.

This involves…

Transferring to claims processing and EOB accounting

Reiterating patient demographic information

Reiterating NPI and your organization’s tax ID

Asking about claim status

Recording the results and planning follow-up phone call dates if necessary

Repeating steps 1-4 for every claim and every payer

Somewhat Ideal: Logging Back Into Payer Portals

Ahh…yes, payer portals.

In this alternative, you log back into every payer portal for every claim and check their status. Your computer monitor will end up looking something like the image below…

Hopefully, you’re using at least an Excel spreadsheet in tandem with this process to record your results. After all, we’re “electronic” in this instance.

More Ideal: Clearinghouse Claim Status

Alright, so we’re back in our PM/EHR that’s integrated with the best clearinghouse known to man (you realize that’s ours by now most likely).

You use this tool every day, so why not make it a habit to check the “claim status” section that’s included with and provided by your clearinghouse? It’s already integrated with practically every payer that exists in the mental health billing world…so it can pull up the claim status for everything you’ve submitted through it.

What a relief.

Most Ideal: Clearinghouse Claim Status with Mail Tracking

The unique payers that still cling on to paper stand no chance against the most ideal alternative for claims processing.

You see, in this alternative, when you requested that your clearinghouse generate and mail a paper CMS 1500 or UB-04 form to this payer, it also generated a tracking number.

That way, you can easily tell the status of that piece of mail and whether or not the paper claim got to the payer’s address.

To sweeten the deal, the form that you sent came with a return envelope and form for the payer to fill out and resend to you about the claim’s status.

Step 7: Recording and Reviewing Denials

The claims that come back to you with a denied status are particularly important.

This is where that statistic in the introduction ties in. If the average denial rate for submitted claims is more than 11%, you should expect to lose that much revenue.

You don’t want to write off that much of your bottom line.

However, as we know from the first definition I gave you, denials aren’t a dead end. You can rework them and submit them for an appeal.

Let’s just stick with the “More Ideal” alternative from now on. Your clearinghouse should also keep a record of your denials and place them within work queues to kick off the appeal process.

Step 8: Reworking, Resubmission and Appeals

You did it, you made it to the final part of the process.

The last step in the mental health billing process is to rework your denials and submit them for an appeal.

If your client’s claims get denied, don’t take it personally. Health insurance organizations don’t make this entire process easy, but they have their rules.

The truth is that 86% of denials are avoidable while 24% aren’t recoverable.

So, if you rework them, you’ll be able to recover more revenue that’s otherwise written off.

Your clearinghouse should be able to help with the denial recovery process by explaining what happened, pointing out errors, and generating appeals letters or resubmitting corrections to payers.

Biggest Takeaway: Choose The Right Clearinghouse

Since a clearinghouse acts as a middleman between you and insurance organizations, they’re an essential piece of the mental health billing puzzle.

They should have features included within it that I also included within the terms section from earlier as well such as; rejections, claim scrubbing and denial management. Those features are industry standards at this point.

However, you’re in a unique scenario within the mental health space where you have to deal with MCOs, mental health EHRs and state-level government ordinances. Thus, if you don’t have a clearinghouse that has specific processes in place to help you with each of those mental health billing-related aspects, you should seek a new one.

MCO Connections

If your clearinghouse doesn’t have electronic connections to the Medicaid MCOs within your state, you won’t be able to submit claims that use Medicaid as their insurance.

Even beyond that, though, there are essential “connections” that your clearinghouse needs to have with MCOs. I’m referring to actual people.

You see, MCOs are usually still large insurance payers, making it hard to get through to them regarding a specific claim from one of your clients. So, your clearinghouse should have direct contacts to reach out to on your behalf regarding any issues with your claims.

To further emphasize the importance of a clearinghouse partner who has relationships with MCOs, it should have connections on a county board level as well.

To give you an example, there are public payers for every county in the state of Ohio that handle alcohol, drug addiction and mental health services (ADAMHS). There are 175 counties in Ohio.

If your organization is in Ohio and your clearinghouse doesn’t have electronic connections or personal contacts for each of the 175 ADAMHS payers in each of the state’s counties, you’re in trouble.

Familiarity with Mental Health EHRS

Many clearinghouse solution providers will ask you what EHR your organization utilizes during initial deliberations.

It’s likely that the bulk of the solution provider’s clients are doctor's offices. A telltale sign that who you’re evaluating isn’t a leading mental health clearinghouse is if they don’t have experience integrating with the EHR your organization’s using.

The EHR you’re using probably isn’t the same one that a pediatrician’s private practice utilizes. Both EHRs serve different niche’s within the healthcare industry so they probably also have different features. That shouldn’t be a roadblock to integrating with a clearinghouse provider.

Stays Attune to Mental Health Billing Changes

Unfortunately, the mental health billing landscape changes frequently. To help illustrate that point, I’ll give you another example of what this industry is like within the state of Ohio.

In July of 2021, Paramount Advantage issued a lawsuit against the state of Ohio for losing out on an Ohio Medicaid contract worth millions of dollars. That lawsuit caused a delay in the new Ohio MCO awarding slated for 2022.

Also in July of 2021, Ohio’s governor, Mike DeWine, signed Ohio’s 2022-2023 operating budget. Many mental health organizations within the state anticipated that it would lead to rebids of Ohio MCO awarding. The final budget didn’t include any information regarding that.

Changes in the mental health billing landscape happen on what seems like a daily basis. You can’t expect to stay “in the know” regarding everything that happens…you have clients to care for. Your clearinghouse provider should pay particular attention to all changes that have a direct impact on your organization’s billing processes and automatically make adjustments to accommodate you.