The business of health care continues to challenge states. States are wrestling with consolidation across the health care market that is driving price and affordability challenges, market disruptors, and the increased involvement of venture capital and private equity. NASHP’s opening plenary for the 2023 Annual Health Policy Conference featured experts on the business of health care and its impact on patients, employers, and the economy. The plenary included a discussion of the complexities of health care, a rapidly changing health care market, and complex market developments that face state policymakers.

At the opening plenary, NASHP Executive Director Hemi Tewarson was joined by:

- Zirui Song, Associate Professor of Health Care Policy and Medicine at Harvard Medical School and a General Internist at Massachusetts General Hospital

- Erin Fuse Brown, Professor of Law and Director of the Center for Law, Health, & Society, Georgia State University College of Law

- Ellen Herlacher, Principal, LRVHealth

- David Fairchild, Senior Vice President, CVS Health, and Chief Medical Officer, Retail Health

Privatization of Health Care

The session started with an overview by Zirui Song on the current state of privatization in health care in the U.S. and the pace, promise, and pitfalls that it poses for policymakers. He identified that by 2022, 74 percent of doctors were employed by hospitals or corporations and that the percentage of medical and surgical practices owned by hospitals or systems grew nearly as rapidly over a 10-year period. These ownership changes translate to facility fees for patients and referral pattern changes that drive patients to higher cost hospital or corporation-owned facilities and practices. Continued vertical and horizontal mergers and acquisitions translated into health care price increases of 114 percent over the past 23 years, while other goods and services increased by 80 percent.

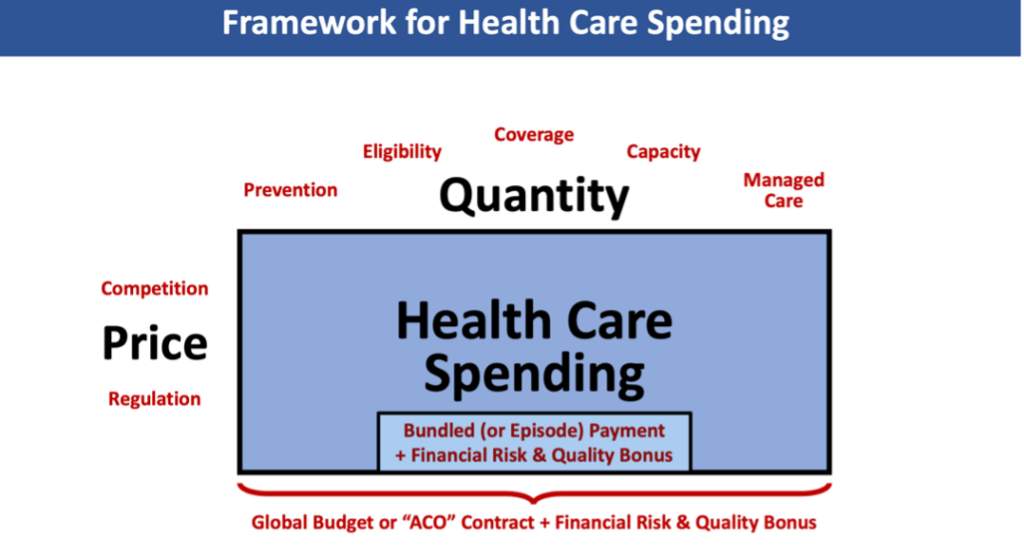

Song said increased reimbursement associated with risk adjustment can incentivize upcoding by providers that not only increases costs but causes moral injury to the relationship between a physician and patient. The framework he presented (see below) describes ways to address the business decisions driving health care costs; the competition lever, which includes price regulation, is the most important lever to address high prices.

States are looking at global budgets and bundled payments, types of value-based payment, as ways to address the rising prices facing states, employers, and residents, but value-based payment models need to ensure appropriateness of care.

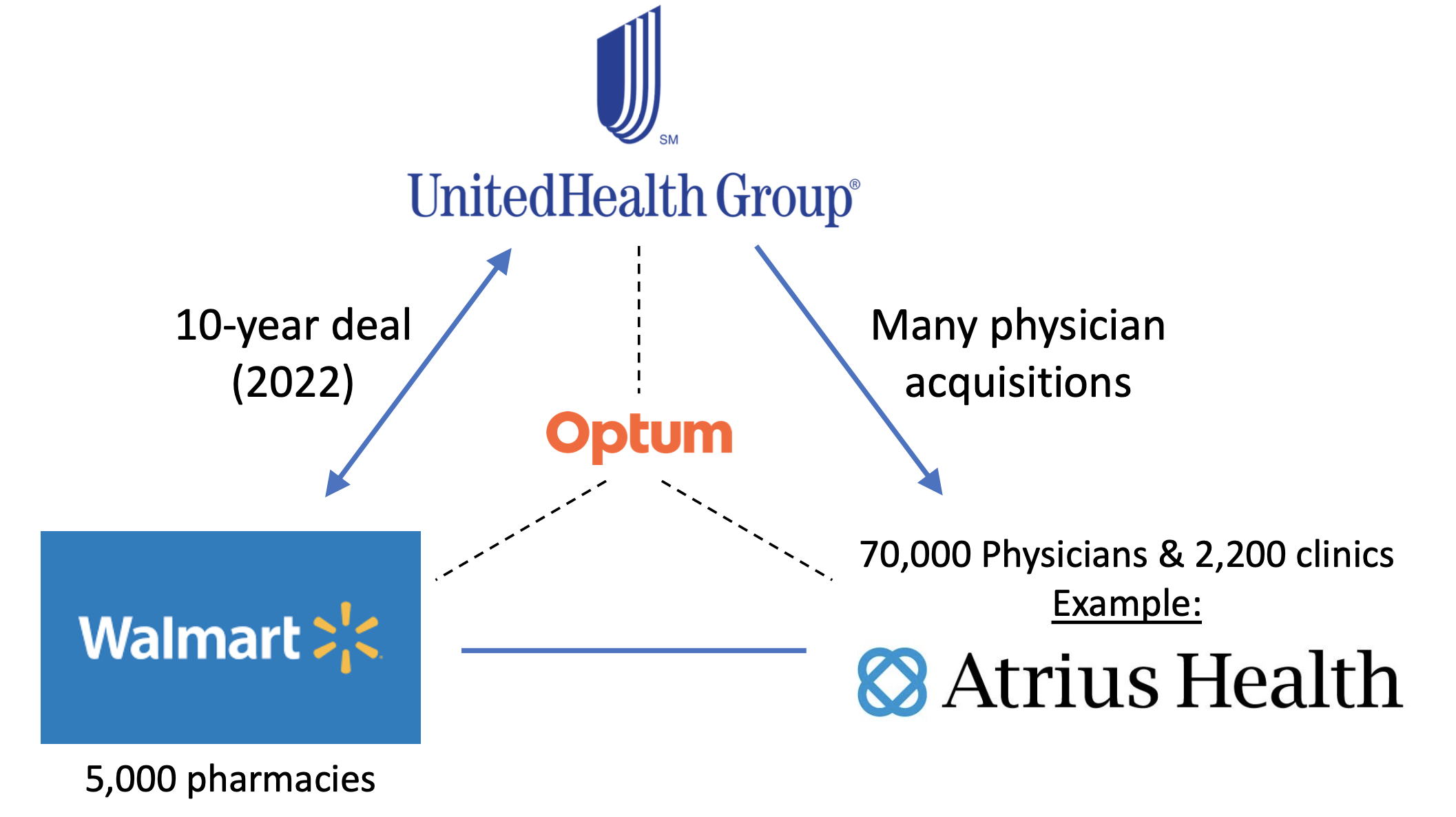

Song described how there is an emerging form of an iron triangle in health care–see example below: large value (multibillion dollar) transactions in which large entities and large employers control or are a part of large deals with pharmacy benefit managers, pharmacies, providers, and carriers that are interdependent on each other’s successes.

An area of common concern for states is the increasing role of venture capital and private equity in health care. Venture capital typically comes in at an earlier stage of investment for startups and early ventures and holds a minority stake and smaller investment size as compared to private equity. The increased penetration of private equity ownership of hospitals and physician practices is associated with price increases and quality of care impacts.

Addressing the Business of Health Care

Erin Fuse Brown, Ellen Herlacher, and David Fairchild joined Hemi Tewarson and Zirui Song for a discussion of the impacts of the changing market and how states could address such impacts. The discussion focused on the following areas:

State Concerns Regarding the Changing Market

States are increasingly concerned about the effects of horizontal and vertical consolidation of and within health care systems and about venture capital and private equity investment in health care, including effects on patient care and access. States are also concerned about the potential of moral injury to physicians and providers incentivized by private investment in practice acquisitions. Yet, providers need investment to create capacity and compete in the current market.

Concerns center on the fact that acquiring entities are often not health providers, that they may not understand best practices in clinical care, and that perverse financial incentives may create quality of care issues. There are also concerns with the quality of care in nursing homes, in particular, which are increasingly owned by private equity. Concerning actions of acquiring entities may include:

- Cutting staffing and replacing them with ancillary providers

- Cutting staff to patient ratios

- Taking steps to increase utilization of services

- Increasing prices or costs through referral patterns and site of service differentials

Understanding the Role of Investors

States are beginning to address the incentives of players in the market. The panelists provided perspectives for states on investors in health care. The trend of corporate investment in health care is here and cannot be uprooted, but states can think about how accessing capital may exploit low-hanging payment loopholes that need to be closed. Concerns about private equity are valid, and states should look at the mission, value, and incentives of companies that own provider groups.

Venture capitalists (VCs) provide pre-revenue for the partner or entrepreneur who wants to configure delivery of a product, and VCs often provide the first dollars in to commercialize. VCs need to consider what happens when overlaying provider incentives may be inconsistent with patient needs. To invest, a VC needs to know how an idea attaches to the health care system. The VC’s role is not to add layers of cost to the system but to look ahead to the goal that the partner or entrepreneur wants to achieve.

State Options to Address the Changing Market

States can address the impacts of the changing business of health care. Some states already address issues through legislative or administrative efforts. States interested in addressing these issues can consider the following actions:

- Review transactions below the $111.4 million Federal Trade Commission Hart Scott Rodino Act threshold and exert market oversight.

- Address clinical care issues through certificate of need and licensure, though resources may be an issue for states.

- Use tax-exempt authority (for not-for profit entities), fraud and abuse laws, and Medicaid authority when there are egregious quality of care issues.

- Strengthen corporate practice of medicine laws to allow professionals to maintain professional and operational control over practices, ban non-compete agreements, and enact whistleblower protections for providers.

- Look at the mission, value, and incentives of companies that own provider groups.

- Find the non-high-value money makers and aim policy efforts at those concerns rather than targeting the investment process.

- Look at investments positively where there are strategic objectives without a current market solution and look to private capital to solve issues where the current system isn’t incentivized or designed to address it.

- Build from quality and use data to move more toward value and expose price and utilization variation to help make changes and realign around value-based care.

- Diminish the power of private incentives and maximize the human side of health care.

The business of health care means states need to address the evolving landscape in creative ways. States face the challenge of aligning three things that have never aligned before: profits for the private sector, patient welfare, and societal resources.

The panelists provided states options for addressing or thinking about how to respond to the impacts of the evolution of the business of health care on access, affordability, and quality by sharpening existing tools or developing newer tools. NASHP will continue to support states in their efforts to ensure the business of health care meets states’ goals to improve quality and access, while containing price and cost growth and improving equity.

Resources for States

- NASHP’s Hospital Cost Tool

- NASHP’s Model Legislation and Resources

- NASHP’s Weighing Policy Tradeoffs: Building State Capacity to Address Health Care Consolidation

- State Action on Pharmacy Benefit Managers to Address Prescription Drug Pricing

- Addressing Health Care Costs: Tools for State Employee Health Plans