Most people with either public or private healthcare insurance like their coverage—but they like it a lot less when they’re sick, according to a new KFF survey.

The KFF analysts polled 3,605 American adults with insurance coverage and found most people have trouble understanding their insurance policies regardless of education level. In addition, those surveyed said good mental health care coverage continues to grow as a concern, and many said they're not satisfied with the choice of providers available in their plans.

The study highlights that Americans seem to have a love-hate relationship with their insurance coverage, and their feelings often depend on what sort of coverage they have as well as their income, race and/or ethnicity.

Even those with positive feelings toward their healthcare coverage can note troublesome problems they want to see addressed.

KFF found that 81% of insured adults give their health plan an “excellent” or “good” rating. Those mostly positive ratings cut across coverage types explored: employer-sponsored insurance, Affordable Care Act (ACA) marketplace plans, Medicare and Medicaid.

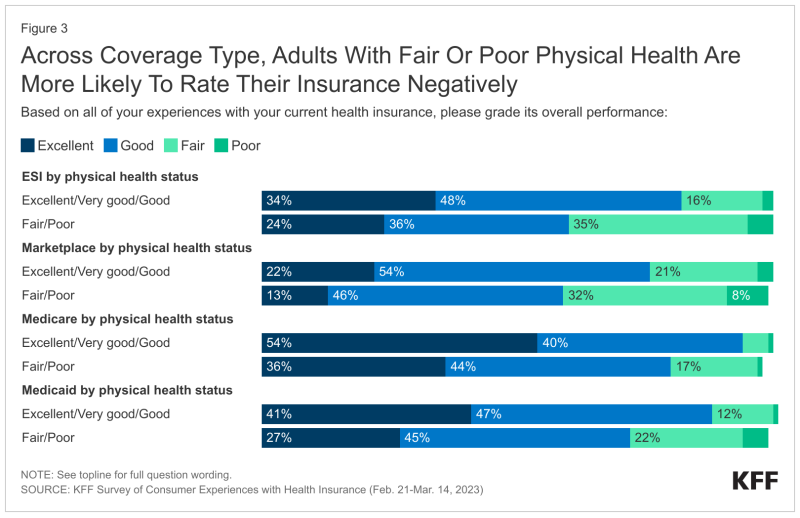

However, the survey also found that while most insured adults who consider their health “excellent” or “good” give their health insurance coverage an overall positive rating (84%), that drops to 68% among adults who considered their health to be “fair” or “poor.”

Medicare beneficiaries felt the most positive about their coverage (91%), while those in ACA marketplace plans felt the least positive (73%).

“Having coverage is valuable to people, and so not surprisingly, most who have it rate it favorably overall,” the survey said. “But we don’t buy health insurance in case we stay healthy, so monitoring how coverage works for people who are sick is particularly important in gauging how well our health insurance system works when people need it the most.”

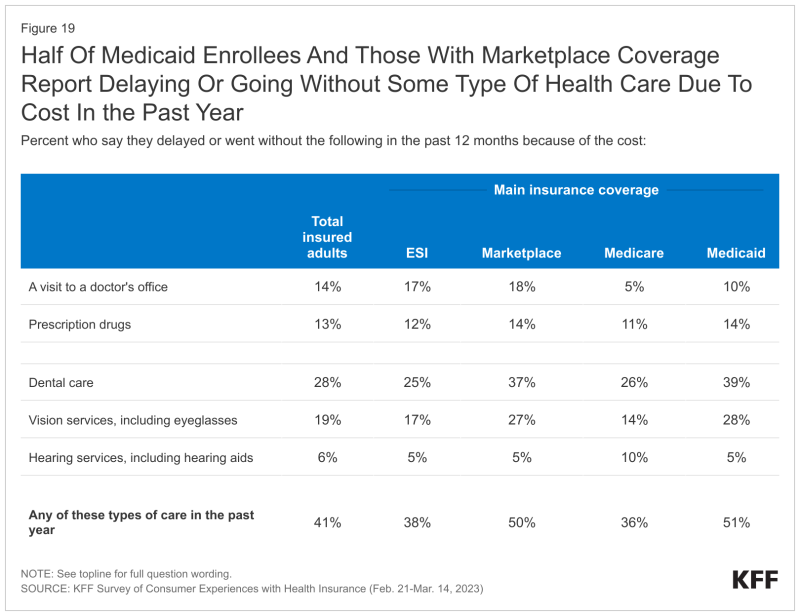

For instance, in the last year, the survey found that 27% of adults said their health insurance covered less than they expected, with 18% saying insurance didn’t pay anything. Twenty-six percent said that they couldn’t make an appointment with an in-network provider, while 14% said their insurance did not cover care at a particular doctor or hospital they wanted to use

Sixteen percent said their insurer denied or delayed prior approval for needed care, according to the survey.

Although most insured adults gave payers positive marks for prescription copayments (61%), premiums (54%) and out-of-pocket costs, that outlook also changed depending on the type of coverage.

For example, 46% of those enrolled in employer plans and 56% of people with marketplace coverage rated premiums "fair" or "poor." More than a third (35%) of those with employer-sponsored coverage and 43% of people with marketplace plans said the same about copayments for prescriptions.

By comparison, 1 in 5 Medicare beneficiaries rated their out-of-pocket costs as "fair" or "poor," according to the survey.

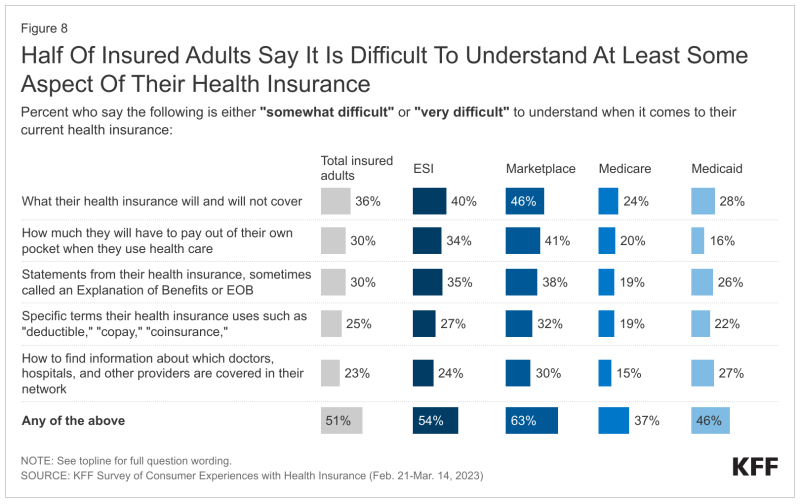

While payers have taken steps to help members understand their benefits, the survey makes clear that there's still work to be done. Respondents were asked about their familiarity with key aspects of health coverage, including critical aspects like how to find providers and key terms like "deductible," "allowed amount" or "prior authorization." Over half (51%) said that they found at least one of these terms difficult to understand.

This trend held true across education levels, the survey found. Fifty-eight percent of college graduates said they had difficulty understanding an aspect of their insurance coverage.

“What people have difficulty understanding varies somewhat depending on their type of coverage, with people covered by private insurance through an employer or the Marketplace generally having more trouble comprehending their insurance than those enrolled in public coverage through Medicare or Medicaid,” the survey said.

About 9 in 10 insured adults said they approve of mandates for insurers to maintain accurate and up-to-date information about their provider networks, claims denial rates, easy-to-read explanation of benefits documents, advanced notification about what’s covered and out-of-pocket costs.

About 80% said they would like to see the creation of a consumer assistance program to help them understand health insurance issues.

“Trying to fix a health insurance problem can be time consuming,” the survey said. “Among adults who say their insurance problem has been resolved, either satisfactorily or not, 27% say it was resolved the same day it occurred, 25% say it took more than one day but less than one week, 31% spent one to four weeks, and 17% spent more than one month.”

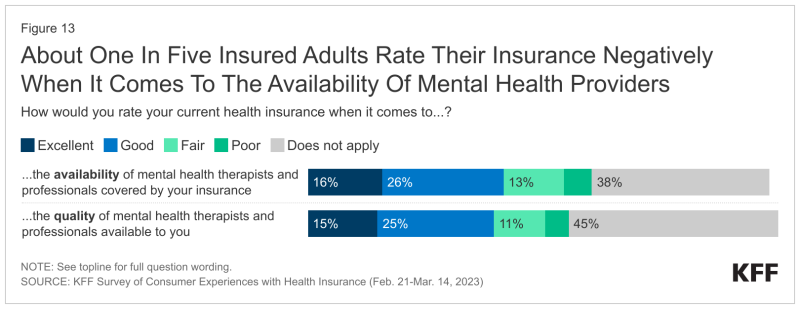

Mental health has become a major concern for employers and other payers, spurred in part by anxiety caused by the COVID-19 pandemic.

Many people surveyed reported problems accessing mental health care (45%), including those who describe their mental health as “fair” or “poor," with younger people as well as Black and Hispanic respondents the most likely to do so.

“Given that many insured adults don’t attempt to access mental health services, it is useful to examine impressions of mental health coverage among those with greater mental health needs,” the survey said.

Forty-five percent of people who described their mental health as "fair" or "poor" gave their insurer a negative rating for the availability of mental health therapists and professionals, with 56% of those with ACA marketplace coverage saying so.

Survey respondents cited many reasons for not getting mental health care, with 37% saying that their insurance wouldn’t cover it. Others said that they couldn’t afford it (44%), they couldn’t get an in-person visit (42%) or that they just didn’t have time (47%).