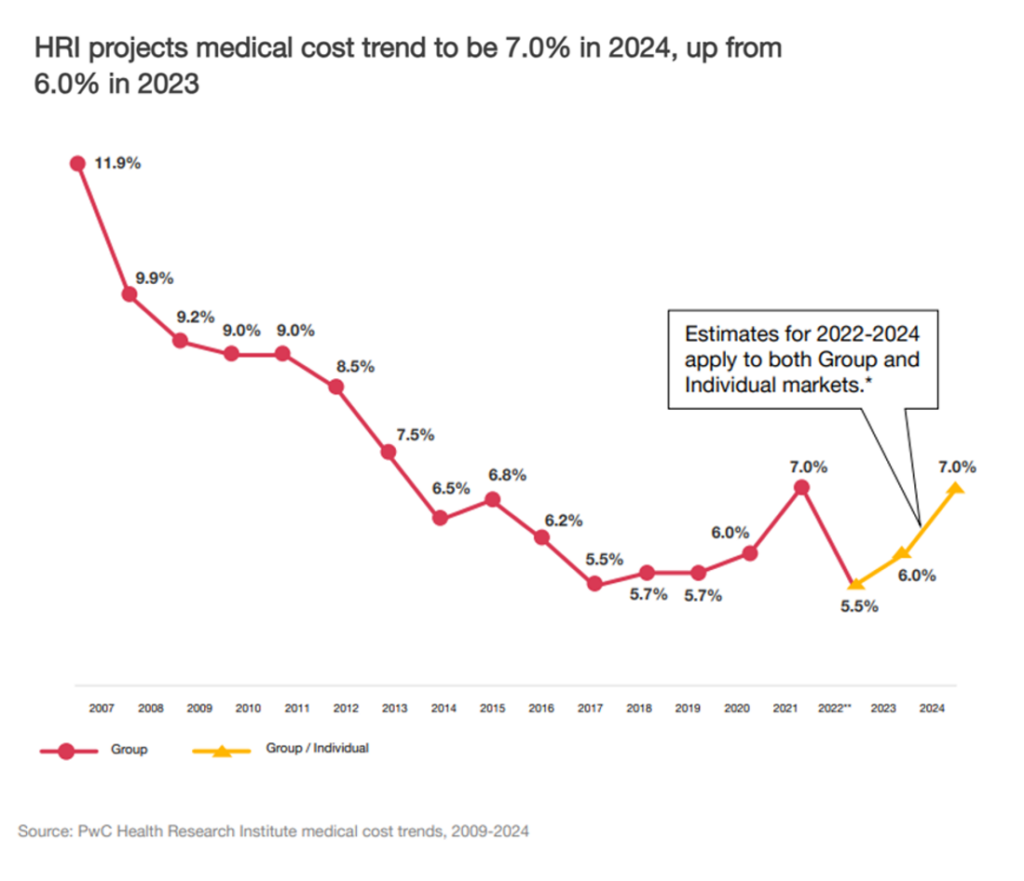

Health care cost trend will spike up another percentage point to 7.0% in 2024, according to the annual report from the PwC Health Research Institute, Medical cost trend: Behind the numbers 2024.

Every year, the PwC HRI team goes behind those numbers to assess cost inflators and deflators which underpin annual medical inflation.

As the first line chart illustrates, the peak of medical trend in the last 18 years was in 2007 when the U.S. saw double-digit cost growth of nearly 12%.

Here’s a link to PwC’s 2007 study looking behind the numbers, noting that the 11.9% medical cost trend was driven by,

- Inflators such as new treatments and prescription drugs, increased demand, cost-shifting, and declining health status among patients attributable to obesity and general aging leading to more expensive conditions; and,

- Deflators like cost-sharing (as consumer-directed health plans were allocating more costs to health plan members having “more skin in the [financial] game, price transparency making some health care spending more “shoppable,” the growth of electronic health records lowering administrative costs, and health and wellness programs beginning to deliver an ROI for certain population health challenges the programs were targeting.

PwC identified the inflators and deflators on medical cost trend as,

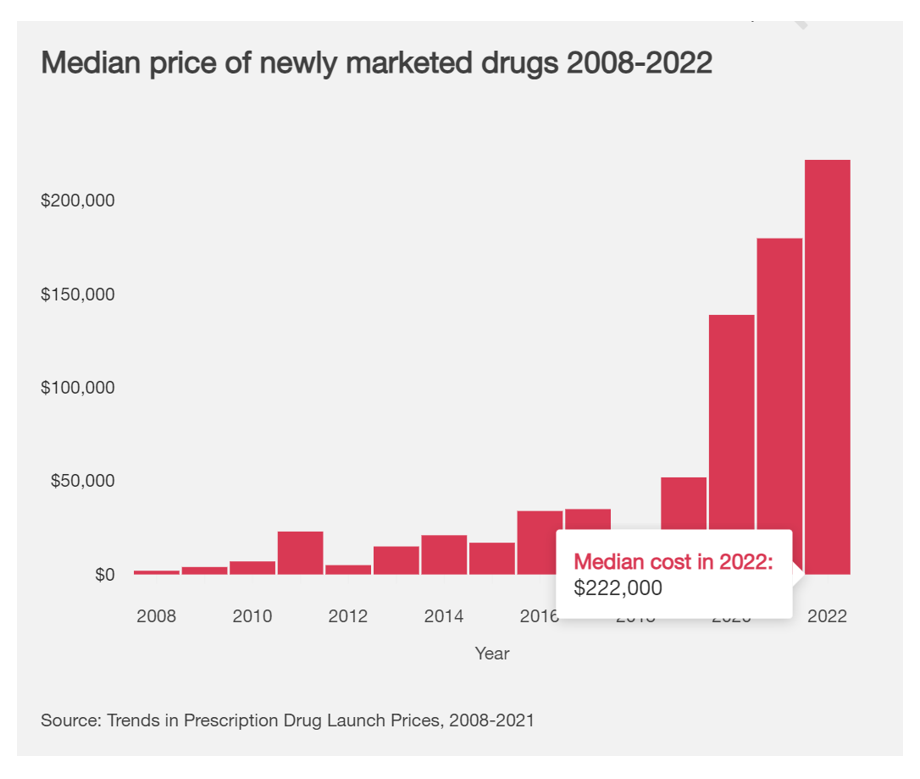

- Inflators with inflation for hospitals and physicians due to workforce shortages and clinician burnout and the increasing cost of pharmaceuticals

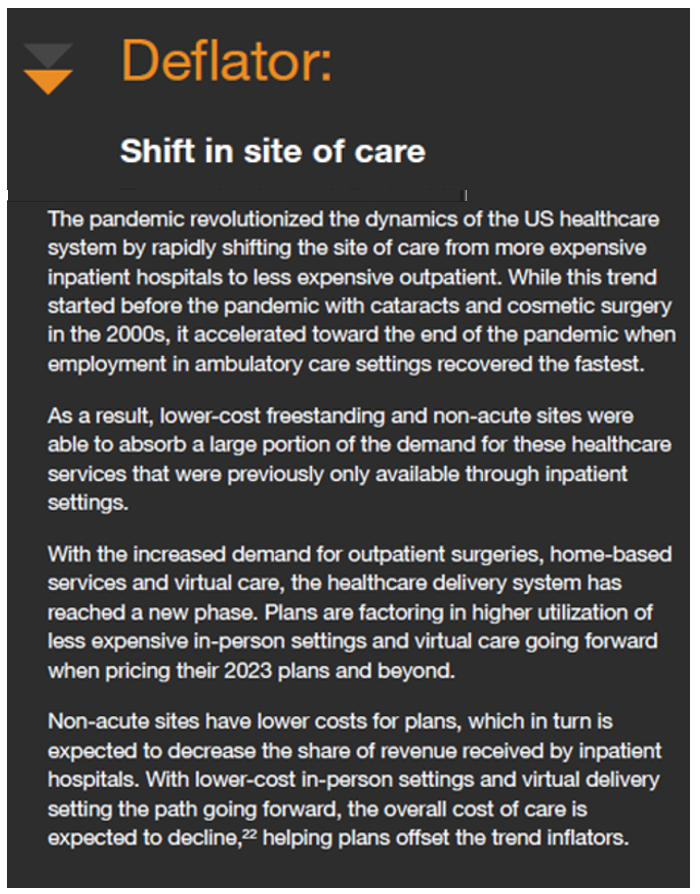

- Deflators include the countervailing impact of biosimilars coming onto the market offsetting some of the prescription drug price growth, as well as shifting sites of care to the home and closer-to-home in lower-cost community-based settings.

Take prescription drugs pushing medical trend upward. The chart on the median price of newly marketed drugs between 2008 and 2002 shows the cost in 2022 reaching $222,000. Since 2019, we can see the hockey-stick increase in the price of specialty drugs fast-growing.

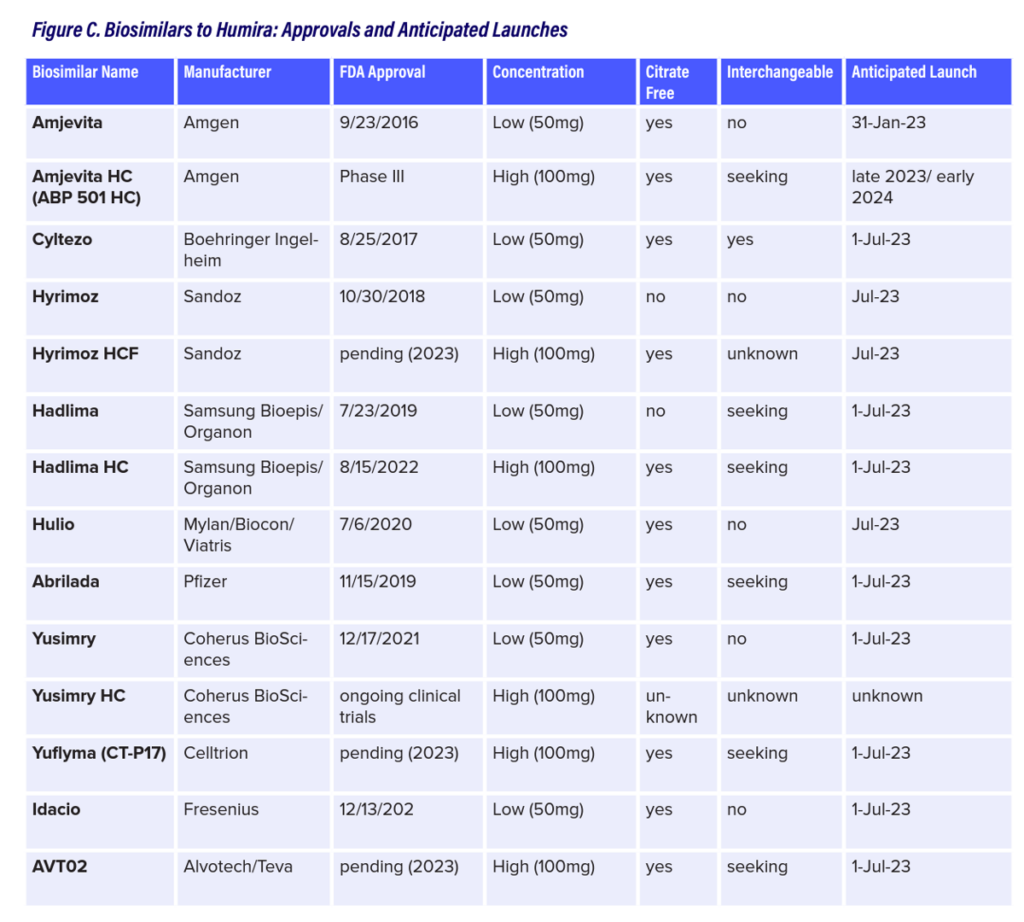

At the same time, the countervailing pressure on Rx prices downward come from the growth of biosimilar products coming on-stream, priced on average 50% lower than the reference price of products at the time of the launch for the biosimilar. In 2023, the Humira biosimilar launch is seen as a “new milestone” for biosimilars in the U.S.

Here is a deep analysis from GoodRx on the launch of at least 9 Humira biosimilars for 2023, foretelling this one product alone could have a major impact on the overall cost of prescription drugs in the U.S. for 2024 medical trend. What NPR coined as a 20-year $200 bn monopoly for AbbVie could quickly bottom out. Goodroot forecasted the impact of Humira biosimilars, developing this table in the report which shows the potential competition for that monopoly franchise.

Expecting to see 12 biosimilar products to substitute for Humira in 2023, Goodroot asserts, “competition will largely depend on the economics dictated by AbbVie. If they increase their rebate, it will be nearly impossible for biosimilars to make the cost [savings] impact that many are hopeful for,” noting that there could be a tipping point in biosimilar pricing where a big enough differential could motivate payors to shift formularies to biosimilars at, say, 50% or more.

Another key shift that serves as a medical cost trend deflator is the shift in site of care, to homes, community-based care locales, and outpatient healthcare settings such as ambulatory surgery centers. PwC calls out this transformation which the COVID-19 pandemic accelerated, when the report notes ambulatory care settings recovered the fastest compared with other delivery sites in the healthcare system.

We’ve reached a new phase in health care in the U.S., PwC calls out, with virtual care becoming part of omni-channel, more hybrid health care delivery models to help health plans offset cost drivers forcing the curve up and to the right.

Additional trends to watch will be,

- Continued efforts to manage the total cost of care (that is, value-based care models)

- A COVID hangover, boosting provider unit cost increases and pharmacy trends

- Behavior health and mental health services growing, and,

- Health equity getting more attention and resources on both the public sector (e.g., CMS) and commercial/private side of health plan strategies.

For this study, PwC conducted 21 surveys and 12 interviews in April through May 2023 among health plan actuaries covering about 100 million employer-sponsored lives and 10 million ACA marketplace members.

Health Populi’s Hot Points: PwC summarizes the “heart of the matter” at the front of the report: that the cost of treating patients is on the rise.

There was a sort of two-year hiatus in health care cost inflation driven largely by patients avoiding preventive screenings and in-person visits and stays in hospitals and clinics.

That’s history.

More patients are coming back to health care, abandoning their personal health mitigation strategy of “medical distancing.”

But “showing up” to health care has begun to morph into new formats beyond “going to the hospital” or a physician medical encounter.

We’re in an emerging age of omni-channel health care where many patients feel and act more empowered to shop for medical appointments (say, via ZocDoc), leverage digital front doors via telehealth or encrypted messages on patient portals with providers, and taking advantage of tele-mental health therapy with counselors who were not so available pre-pandemic.

We’re living in/through and must plan for these ongoing changes, whether we work in provider organizations, health plans, pharma and life science companies, and to be sure, technology and retail/health organizations. While the cost of treating patients is on the rise, have no doubt that the patient-as-payor will be determining much of that spending.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.