The rate of people in the U.S. skipping needed health care due to cost tripled in 2021.

This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index.

The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens.

Furthermore, 93% of people in America feel that they pay too much for health care and don’t get the value commensurate with that cost.

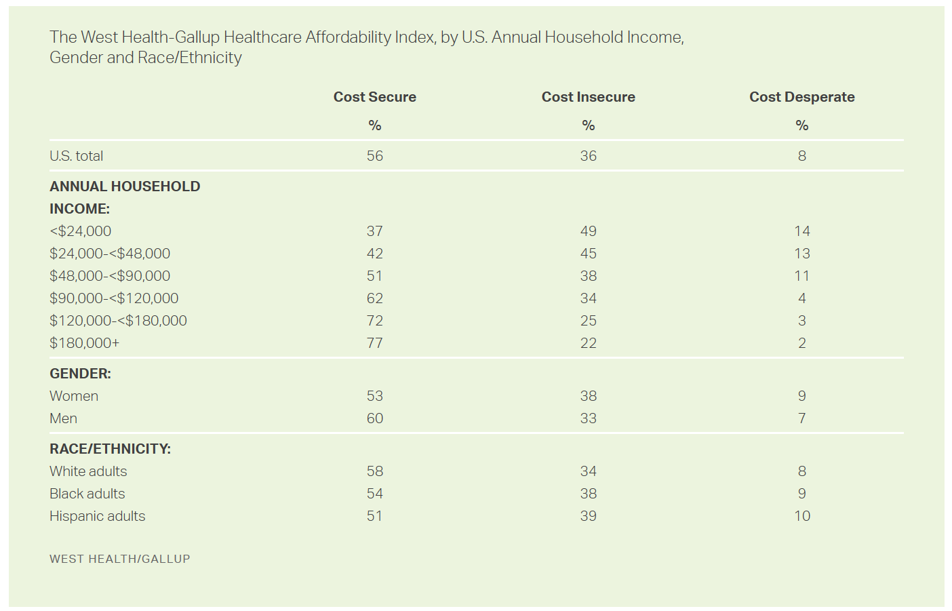

The first chart for the Healthcare Affordability Index shows the proportion of people in the U.S. who feel cost secure, cost insecure, or cost desperate.

People who are cost desperate face the most extreme challenges, all three of these factors:

- Unable to pay for needed medical treatment over the past three months

- Skipping prescribed medications due to cost in the past three months, and

- Unable to afford quality care “today.”

Cost insecure folks face one or two of these medical financial challenges

Note that one in five people earning over $180,000 a year feel cost insecure, and another one in 4 people earning between $120-180K do.

One-half of people earning under $48,000 annually feel cost insecure. And the most cost-desperate health citizens in America earn under $48K a year, some 13-14% of people.

More women than men feel cost insecure, and more Black and Hispanic adults than White adults.

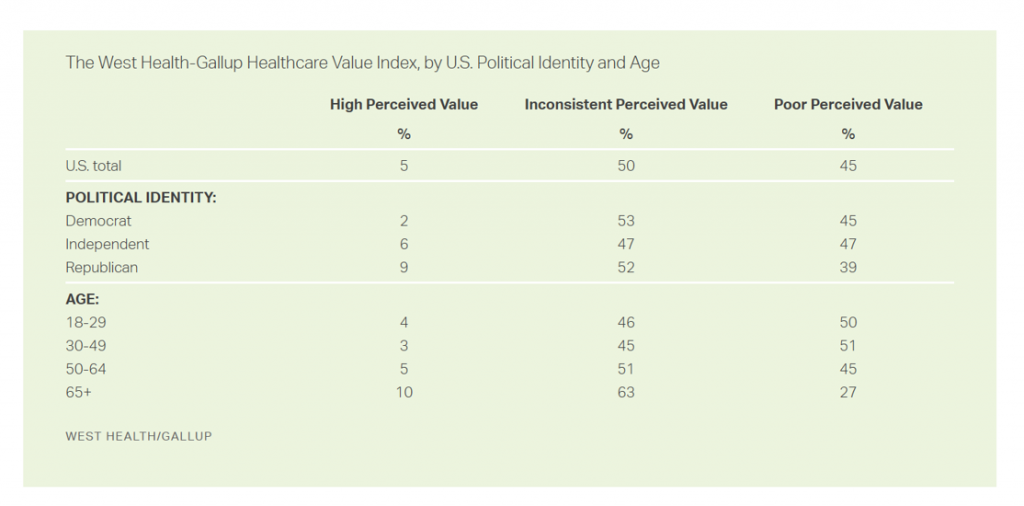

Judging the value of U.S. health care, one-half of U.S. adults perceive inconsistent value or poor value.

Across political party, there is some concordance between Democrats and Republicans, over one-half of which share inconsistent perceived value for health care in America. A plurality of Dems and GOP voters see poor value in health care, 45% and 39% respectively.

By age, fewer people over 65 perceive poor healthcare value in the U.S. compared with people under 65 about one-half of whom have poor value perceptions about U.S. health care. The older peoples’ more positive views on health care value (relatively speaking) may have to do with their perceived value of Medicare coverage compared with younger people who would be more likely covered by commercial insurance (with high deductibles) or Medicaid (variable experiences by State).

This study’s definition of poor perceived value is:

- The consumer saying they paid too much for the quality of care received, as well as

- The most recent care experience not worth its cost.

Inconsistent value is defined as (1) or (2).

The research was conducted online in September and Octoberr4 2021 among 6,663 U.S. adults 18 and older.

Health Populi’s Hot Points: The West Health and Gallup alliance will continue to track health care affordability and value trends over time to inform public policy, payers, and consumers.

This baseline read is that 3 in 4 U.S. adults do not consider the quality of care in America to be worth the cost-spend — which by 2022 runs about $1 in every $5 for every household in America.

The lack of faith in the value of care for that investment is shared across demographics as shown in the tables — whether age, gender, income, or race.

Still, race, ethnicity, and income matter when it comes to health care outcomes, the ROI on medical spending. And people who are Black or Hispanic, and lower-income people, tend to have worse outcomes in the U.S. medical system.

To understand more on health equity’s relationships with low-value care, see this new video from the University of Michigan Center for Value-Based Insurance Design produced in May 2022 distilling the latest facts and findings on low-value care.

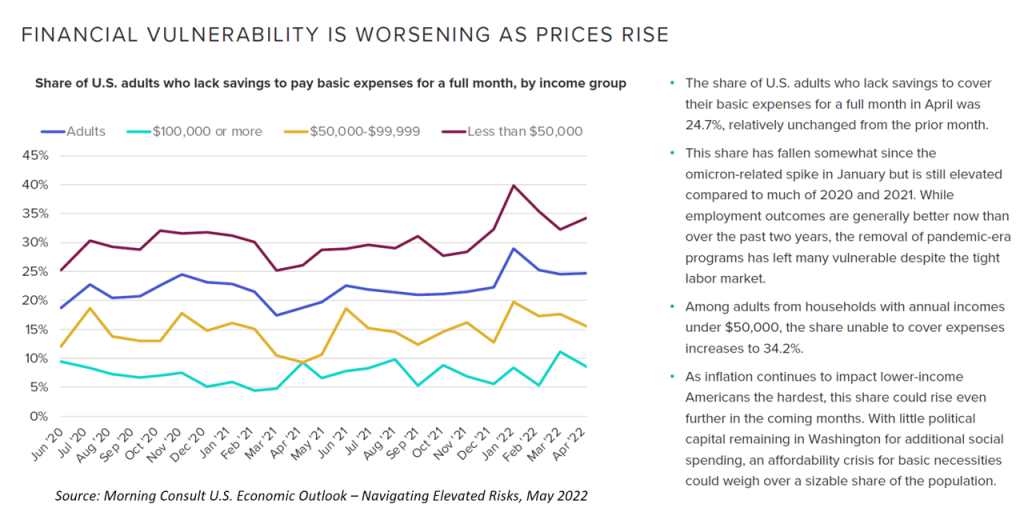

Health care providers and suppliers to the industry should heed the subtitle of Morning Consult‘s latest (May 2022) U.S. Economic Outlook report and, in their words, “navigate elevated risks.” Financial vulnerability is getting worse for people earning lower incomes, with the share of U.S. adults unable to cover expenses growing to over 1 in 3 people.

The bottom-line in Morning Consult‘s assessment shown here in the last bullet is that, “As inflation continues to impact lower-income Americans the hardest, this share could rise even further in the coming months.” The lack of political will to invest more public dollars in social spending and health care in the pandemic-endemic period will exacerbate, in Morning Consult’s words, “an affordability crisis for basic necessities [that] could weight over a sizable share of the population.

Value is in the eye of the beholder and health care payer….increasingly, the patient as the payer.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.