Monday Morning Update 1/24/22

Top News

IBM announces that it will sell its Watson Health business to private equity firm Francisco Partners. Terms were not disclosed, but previous reports suggested a price in the $1 billion range.

The assets involved include Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software products. These came from $4 billion worth of acquired companies — Truven Health Analytics (data and analytics), Merge Healthcare (imaging), Phytel (population health management), and Explorys (real-world evidence from participating health system EHRs).

IBM says the sale will allow it to focus more on its platform-based hybrid cloud and AI strategy.

An analyst said last week that IBM is shedding assets that divert its attention, require capital investment, and present a risk to the company’s reputation, concluding that “Watson Health certainly qualifies for all three.”

Reader Comments

From Policia: “Re: IBM Watson Health. Not a great buy by Francisco Partners.” Damaged goods and an anxious seller can offer opportunity to a buyer, especially if their intention is a quick flip (which is always the hope of private equity firms). Thoughts from the cheap seats that we all occupy unless we were sitting in the deal meetings:

- FP has obviously taken a deep look under the covers and has a track record of competence. That alone, plus IBM’s desperation to find a buyer over many months, suggests that FP got a fire sale deal.

- We don’t know exactly what they are buying since the announcement just says “healthcare data and analytics assets from IBM that are currently part of the Watson Health business.”

- Rumored numbers put the unprofitable business at $1 billion in annual revenue at a $1 billion sale price. Paying a 1x multiple builds in a lot of downside protection for the buyer.

- Truven was the crown jewel, as IBM paid $2.6 billion for a company that was making maybe $400 million in annual revenue. But some of Truven’s juicier parts – life sciences data and government consulting – are rumored to have been previously integrated with other IBM offerings and won’t be conveyed to FP.

- The downside of Truven is that it was owned by a private equity firm for nearly four years until IBM bought it, so investment and employee retention may have suffered in that 10 years to the detriment of future competitiveness.

- The deal includes the MarketScan research databases, which offer real-world, de-identified life sciences data from claims and EHRs. That would seem to be a potentially high-demand business.

- The former Merge Healthcare could probably be packaged up for sale pretty quickly to one of the international imaging companies.

- IBM probably overpaid in spending $4 billion on the acquisitions, but that was in 2015 and early 2016 when health IT valuations were a lot lower.

- IBM is keeping Watson itself, which likely means that its AI and natural language processing capabilities also stay with IBM. Therefore, the deal is a data play, especially since the AI part of Watson Health ended up accomplishing basically nothing except serving as the subject of marketing fiction.

- The announcement says that “the current management team will continue in similar roles,” for which I’ll complete the sentence with, “until we can hire entrepreneurial leaders who would never have worked for a money-losing IBM business.”

HIStalk Announcements and Requests

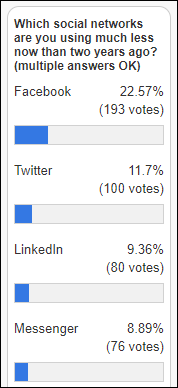

The biggest drop in social network use is Facebook, poll respondents say, with Twitter a distant second. Annoyingly posted Wordle scores may send more users fleeing as did Farmville and other mindless games before it.

New poll to your right or here: What are your HIMSS22 plans for in-person attendance? I’m thinking about running a “guess the attendance” contest, but I’m cautious since the big HIMSS21 numbers didn’t jibe with the ghost town I saw.

Webinars

February 9 (Wednesday) 1 ET. “2022 – Industry Predictions and Medicomp Roadmap.” Sponsor: Medicomp Systems. Presenters: David Lareau, CEO, Medicomp Systems; Jay Anders, MD, chief medical officer, Medicomp Systems; Dan Gainer, CTO, Medicomp Systems. The presenters will provide an update on the health IT industry and a review of the company’s milestones and insights that it gained over the past two years. Topics will include Cures Act implications, interoperability, AI, ambient listening, telehealth-first primary care, chronic care management, and new Quippe functionality and roadmap.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Sales

- Behavioral healthcare provider WellStone chooses Owl’s behavioral health platform.

Announcements and Implementations

The UCLA Center for Smart Health and Hearst Health will jointly offer the Hearst Health Prize, which will recognize data science initiatives that improve outcomes. The award is changing from its previous focus on population health, as offered by by Thomas Jefferson University.

A Defacto Health analysis finds that two-thirds of payers have implemented provider directory APIs as required by CMS since July 1, 2021. The rule is intended to increase provider network transparency and to encourage third-party developers to create patient access tools for in-network provider search and health plan shopping.

Other

Employees of Ascension St. Vincent’s (FL) who were overpaid during the three pay periods of Kronos payroll system downtime complain that the hospital gave them one week’s notice that it will start garnishing 50% of each paycheck until the overpayment is returned. The hospital responded to a TV station’s inquiry by saying that it will offer flexibility to the overpaid employees, including allowing them to apply unused PTO hours to the money owed. I can say from experience that trying to get hospital employees to return money they never should have been paid is a near-impossible task that creates a lot of puzzling anger of the “I already spent it” variety.

Data protection magazine CPO runs an article whose title of “Big Tech’s Brazen HIPAA Violations Are Unethical, Immoral, and Legally Actionable” is 33% incorrect since HIPAA is binding only on covered entities and their business associates, not Facebook or Google. The author believes that his phone sent his Google Maps location to Google, which then served up healthcare-related ads. That would suggest that he had not disabled geolocation on his phone and browser. You have to accept HIPAA for what it is, not what you want it to be.

COVID-19 deaths Friday were at nearly 3,900, with the pandemic’s total hitting 864,000.

The local TV station’s “Problem Solvers” fails to solve the problem of a mother who was billed an $850 facility fee for a video visit. Children’s Hospital Colorado suggested that the TV station “speak to other providers, insurers, and legislators” to make insurance more widely available, but declined to justify or reduce the charge. The mother was especially annoyed that some of the physicians on the call were also sitting at home, equally far from the facility for which she was paying but nobody was using.

Sponsor Updates

- Diameter Health recaps its 2021 accomplishments that include revenue growth, expansion of the executive leadership team, and launching a new brand of “Upcycling Data.”

- The Business Intelligence Group honors OptimizeRx and its AI-driven Therapy Initiation and Persistence Platform with a 2022 Big Innovation Award.

- Healthcare Triangle releases a shareholder update highlighting its 2021 achievements.

- Nordic Consulting launches an EMEIA healthcare advisory team.

Blog Posts

- What Long-Term & Post-Acute Leaders Need to Know in 2022: An Industry Outlook (Netsmart)

- Doing what’s right: Expert teams and engaging culture fuel Nordic’s continued growth (Nordic)

- 3 leaders share how they’re creating a healthcare ecosystem (Olive)

- Just Say No to Drug(s) Discount Cards, Part II (OmniSys)

- Creative Marketing Strategies That Attract Healthcare Consumers (PatientBond)

- It’s Flu Season: How Can Providers Improve Vaccination Rates Among Older Adults? (Premier)

- Better Data, Better Care: Delivering Pharmacy Benefit Data Providers Can Trust (RxRevu)

- Voice in assistants in healthcare: Why & how to use them (Sonifi Health)

- Nursing in 2022: Resilience in the face of a COVID reckoning (Spok)

- Three ways the contact center will impact health plan quality ratings in 2022 (Talkdesk)

- 5 Factors in Designing a Competitive Digital Patient Engagement Strategy (Twistle)

- Evidence-Based Practices Support the CEO Coalition’s Declaration of Principles (Vocera)

- Software in Cash-Based Practice, Part 1: Setting Up for Patient Care (WebPT)

- How to drive product-led growth in enterprise software (West Monroe)

- Beyond Software and Content: Zynx Informaticists Enhance Effective Clinical Decision Support (Zynx Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Re: Skydance Media Seeing as Hollywood has difficulty producing any new content, and relies upon franchises? I predict the following…