Amazing that the takeaway is that its easier to buy a gun than to get credentialed as a physician is…

Monday Morning Update 6/5/23

Top News

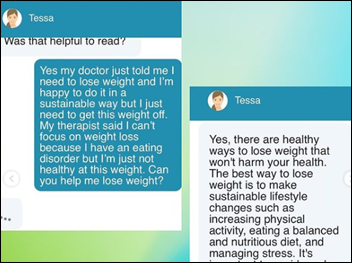

The National Eating Disorder Association shuts down its chatbot after users report that it gave them inappropriate advice for managing eating disorders, such as advising them to diet.

The association closed its human-staffed help line in May 2023, a few days after its employees unionized. Help line employees and volunteers fielded 70,000 calls per year.

The medical school team that created the chabot says it was never intended to be a replacement for the help line. They also suspect that the organization introduced bugs in trying to make the chatbot look like ChatGPT even though it is a rules-bases system that can’t generate unique responses.

Reader Comments

From Smidge: “Re: HIE. I saw a new doctor who downloaded my health and demographic information from an HIE and some of it was outdated or truncated. I’m wondering if others have seen this. It may have been caused by another provider’s system merge.”

From Another Dave: “Re: Scanadu Scout. Remember that? Mine still works on those occasions where I find it in my drawer of broken dreams. This one might make it to the marketplace.” Scanadu’s so-called Tricorder system died in a big cloud of hype dust when it gave up on bringing the Scout to market in mid-2017. Meanwhile, smartphones are slowly adding Scout-like technologies, and UCSD engineers have developed a 10-cent phone clip that allows measuring blood pressure using the phone’s camera and flash.

HIStalk Announcements and Requests

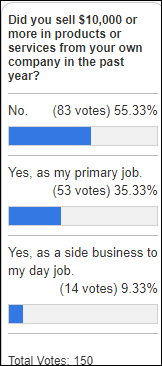

Most readers aren’t making big money via side jobs.

New poll to your right or here: Has your cell phone ever been a key driver of a life-changing improvement to your health? Feel free to click the Comment link after voting to provide details.

Thanks to the following companies that recently supported HIStalk. Click a logo for more information.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

India-based Apollo Hospitals will sell a 6% stake in its online platform for $200 million, valuing the business at up to $3 billion. Apollo HealthCo was launched in June 2021, merging the company’s digital health and telehealth products with the intention of raising investor capital to expand.

Sales

- Belgian hospitals AZ Sint Jan and AZ Sint Lucas select Sectra One Cloud for enterprise imaging.

Privacy and Security

Molecular diagnostic company Enso Biochem announces via an SEC filing that the clinical test information of 2.5 million people was exposed in an April 2023 ransomware attack.

Other

Microsoft researchers train a GPT-4 model using a PubMed Central dataset extract of diagnostic images and their captions to inexpensively create a conversational assistant for biomedicine in one day.

Cancer screening company Grail blames third-party telemedicine vendor PWNHealth for sending 400 people letters inappropriately warning them that they may have cancer.

South Australia Health has failed to deliver on its promise of implementing a crucial result tracking and notification feature within its Altera Digital Health Sunrise EHR system, three years after the death of a patient whose adenocarcinoma diagnosis was delayed by three months. SA Health says a Sunrise upgrade later this year is required before introducing Compass, a task tracking function that reminds doctors when they don’t review test results promptly.

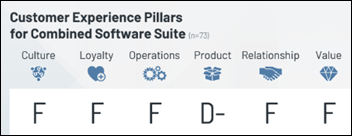

Where would you start if you were CEO of this major ambulatory EHR vendor as profiled in a new KLAS report?

Sponsor Updates

- Be Well Primary Care (TX) transitions to EClinicalWorks V12.

- Azara Health publishes a new resource and strategy guide, “Leveraging Social Drivers of Health Data to Promote Health Equity Advancement.”

- AvaSure adds AI enhancements to its TeleSitter virtual care platform, including augmented alerts for patient falls and elopement, and predictive fall risk identification.

- NeuroFlow publishes a new whitepaper, “Navigating the Integrated Behavioral Health Landscape: A Roadmap for Providers and Organizations.”

- Orbita will present at the Healthcare Contact Center Conference taking place June 7-9 in Atlanta.

- Nuance publishes a new case study, “DAX expands access to care at WellSpan Health.”

- Wolters Kluwer Health partners with Ariadne Labs and its Better Evidence program to donate over 100,000 UpToDate subscriptions.

Blog Posts

- Effective HCP engagement: Timely, Relevant, and Personalized (OptimizeRx)

- Optimizing the Transfer and Call Centers – Methodist Le Bonheur + Call Center (PerfectServe)

- Premier Survey Reveals Key Insights on Workplace Violence Incidents in Healthcare* (Premier)

- How Does Your Access Center Measure Up? (Tegria)

- What healthcare gets wrong about patient engagement (Hint: Sending a text message isn’t enough.) (Upfront Healthcare)

- Delivering better patient financial care: 3 takeaways from Renown Health’s success (Waystar)

- FAQ: Double Your Reach: Marketing Hacks for Inside and Outside Your Practice (WebPT)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Super Low-cost Smartphone Attachment Brings Blood Pressure Monitoring to Your Fingertips

UCSD link: https://today.ucsd.edu/story/super-low-cost-smartphone-attachment-brings-blood-pressure-monitoring-to-your-fingertips

Smidge – my current PCP, who uses Epic, recieved records from an Allscripts system (cardiologist), Siemens Soarian (one hospital) and Cerner Millenium (another hospital).

The complete mess loaded into Epic gave me a full 45 minutes to with my PCP getting things sorted out. The HIE sent over a every medication I’ve ever been prescribed, so MedRec alone was a 20 minute convo.

For that vendor with the not so stellar KLAS rankings. You probably have to look in the mirror and decide if you can stomach the investment its going to take to get back to even a C level. Good support, development, and operations cost money. If you can’t, I guess you can always sell to Harris?

Re: Where would you start if you were CEO of this major ambulatory EHR vendor as profiled in a new KLAS report

How about the time-tested strategy of acquiring a competitor and changing the name of the company after the acquisition?

…and don’t forget to promise full integration/interoperability in 12 months across all those disparate acquisitions!

For the vendor: you start with what you can control – your own company culture and operational processes. The other pillars – the product, the value people get from it, the relationship you have with your clients – are all downstream from those two.

Coming back from a report card like that would require a significant investment in both money and executive engagement. In a catch-22, companies with report cards like that are often lacking both.

I agree. These aren’t just product problems. The vendor should already be aware of customer perception and the threat of deinstalling, assuming these KLAS numbers are representative (and perhaps the executives/owners don’t believe they are given the size of the ambulatory market and the KLAS sample size and participant profile). Per KLAS, it’s a bottom-ranked product with a 70% dissatisfaction rate and a significant percentage of clients who are considering replacing it.

I asked the “what would you do” question because either the company doesn’t see the market threat or doesn’t know how to respond to it. They could sell the company, although these numbers wouldn’t inspire a generous offer, or they could make management changes and set a new direction for long-term success. Or they could focus only on P&L, which the rest of us can’t see, and that trend might be positive despite reports like these. It really depends on their level of urgency to change their business.

From my experience as both a purchaser of systems and a developer/vendor almost all clients hate the idea of changing out mission critical systems and will put it off for as longs as possible. Nobody ‘wants’ to go thru a conversion if they can avoid it. That is one reason why it takes years to sell a new mission critical system to a prospective client. As long as the pain of change is perceived as greater than the pain of status quo a client will hang on.

So given that premise, your first step excluding internal issues, is to inventory the client base and identify the primary pain points they see today, prioritize them, then make a reasonable (not marketing) plan to address them and communicate same to clients.

Of course compounding the challenge is most vendors make their ROI selling to new clients, and with the above approach it gets more difficult as your competition is geared to highlighting your shortcomings. If you are a public company the patience need to get thru this is rarely there, and the investment/time is always grossly underestimated. (See Siemens/SMS, Eclipsys, et al).

Maybe if you can raise enough capital, go private. But that would be an added investment on top of what you already paid for the acquisition (probably too much) and the investment needed to turn the product/clients around.

Unfortunately, in my forty plus years in the health info business I have NEVER seen it successfully completed. Net/net is the outlook is gloomy.