How to Choose a Clearinghouse

As a mental and behavioral healthcare provider, you want to give your patients the best care and treatment possible. You also want to ensure your practice is paid for the services it provides as quickly and efficiently as possible. Mistakes and errors on the claims you submit to insurance companies can delay payment or cause the company to reject your claim.

Table of Contents

- What Is a Clearinghouse in Health Care?

- The Benefits of Using a Medical Clearinghouse

- How to Determine if Using a Clearinghouse is Right for Your Practice

- What to Look For When Choosing a Clearing House

To streamline the billing process and reduce the number of errors that occur, many providers work with medical clearinghouses, which review and scrub claims before submitting them to insurance. If your practice has not yet started to work with a clearinghouse, learn more about the benefits of working with one and how to choose one that best meets your practice's needs.id=""

What Is a Clearinghouse in Health Care?

A clearinghouse is an intermediary between a seller and a buyer. In financial services, a clearinghouse is an entity that validates a transaction and makes sure both parties fulfill their obligations. In health care, a clearinghouse accepts claims information from a provider. It then reviews the claims before forwarding them to the payer, which is usually an insurance company.

A medical clearinghouse does several things when it reviews claims:

- Looks for errors: A healthcare clearinghouse reviews each claim, ensuring the information it contains is accurate. For example, it will review the patient's name to confirm it's correct and verify the patient's contact information and other details. The clearinghouse makes sure Patient A, who might have a name similar to Patient B, isn't charged for services Patient B received.

- Verifies billing codes: The clearinghouse also reviews the codes the provider submitted to make sure they are the correct ones for the services or treatment received. A payer can reject a claim if the codes aren't accurate, which can delay payment.

- Confirms compatibility: The clearinghouse verifies that the provider's claim is compatible with the payer's software, as well. If the claim is incompatible, it might need to go to a second clearinghouse before it reaches the payer. The clearinghouse can also update the claim to ensure compatibility.

When a provider works with a clearinghouse, the process usually goes something like this:

- The provider creates and submits a claim: Using their electronic health record (EHR), the provider makes an ANSI-X12 - 837 file, which is an electronic medical claim. The provider submits the claim to the medical clearinghouse.

- The clearinghouse reviews the claim: The clearinghouse performs a process called "scrubbing" once it gets the claim. During scrubbing, the clearinghouse verifies the information on the claim and confirms the billing codes entered are the correct ones to use for the services the patient received. The clearinghouse thoroughly inspects the claim to ensure everything is in order.

- The clearinghouse sends the claim to the payer: If the claim passes inspection and the clearinghouse also works with the payer, it will send the claim to the payer. The clearinghouse should use a secure connection compliant with the Health Insurance Portability and Accountability Act (HIPAA). If the payer doesn't work with the clearinghouse, the clearinghouse will send the claim to a second clearinghouse the payer works with.

- The payer accepts or rejects the claim: Once the payer receives the claim, it can accept it and pay it, or it can reject or deny it. If the payer rejects the claim, it goes back to the provider for review. The provider can update and resubmit the rejected claim to the clearinghouse, which will perform the scrubbing and submission process again.

Ideally, the clearinghouse your practice chooses will also work with the insurance companies you bill most often to streamline the claim submission and payment process.

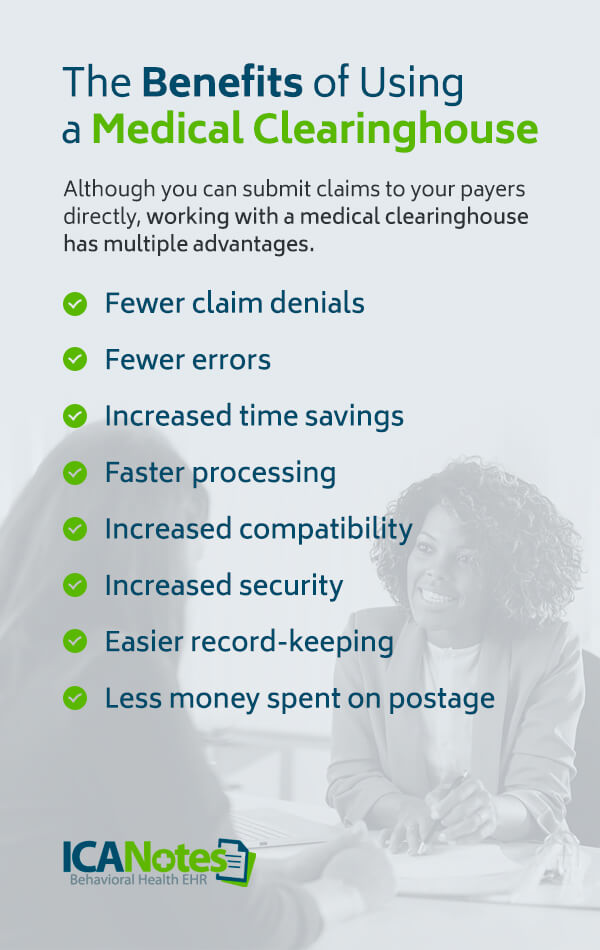

The Benefits of Using a Medical Clearinghouse

Although you can submit claims to your payers directly, working with a medical clearinghouse has multiple advantages. The primary benefit of using a clearinghouse is receiving payments faster. The more quickly your practice receives payment, the better it can continue to provide care to its clients. Take a look at some of the other benefits of working with a clearinghouse:

- Fewer claim denials: Correct information on a claim can reduce rejections that result from typos. When a clearinghouse reviews a claim before it reaches the payer, it's more likely the payer will approve the claim, as any typos or other issues have been corrected.

- Fewer errors: With fewer errors on your claims, you can save time and money. Putting the wrong middle initial for a patient or mistyping their insurance ID number can mean a different payer receives the claim, delaying the payment process or leading to rejection. A clearinghouse checks each claim for errors, including typos in a patient's name or contact information, and makes sure everything is correct before the claim arrives at the payer.

- Increased time savings: Reviewing claims by hand is a time-consuming process. It means your team has to spend time poring over each claim to make sure there are no missing digits or misspelled names. When you use a clearinghouse, your team's time is freed up to focus on other things. They can take more time to provide excellent care to patients or expand your practice's services and reach a larger portion of your community.

- Faster processing: A clearinghouse works with electronic claims, meaning the claims don't have to travel through physical mail. Everything moves more quickly with a clearinghouse, so you don't have to wait days for the payer to get your claims or weeks to receive payment.

- Increased compatibility: The software your practice uses for medical billing may not be the same as the software the payer uses. As the intermediary between you and the payer, the clearinghouse can step in and ensure your claims end up being compatible with the payer's software program.

- Increased security: All claims submitted to a clearinghouse need to travel over a HIPAA-compliant connection to ensure patient privacy. Working with a clearinghouse means increased security compared to mailing in claims or using another electronic method to send them to a payer.

- Easier record-keeping: Using a medical clearinghouse helps to streamline your practice's record-keeping, too. You can log into the clearinghouse to check on each claim's status and see where it is in the payment process. There's no need to sift through stacks of paper or send multiple follow-up notices to check on the status of a claim. All of your claim records are stored in the same place.

- Less money spent on postage: Since you submit claims electronically when you work with a clearinghouse, you don't have to purchase stamps or envelopes or send an employee to the mailbox or post office regularly.

How to Determine if Using a Clearinghouse is Right for Your Practice

Not every provider needs to work with a clearinghouse. If you don't work with payers or only have a small number of patients, you might not need to partner with a clearinghouse. If you don't currently work with one and are wondering if doing so will benefit your practice, there are a few questions you can ask:

- How many insurance companies do you work with? If your practice accepts multiple insurance plans, working with a clearinghouse can simplify your claims submission process and increase compatibility.

- Do you have a high volume of claims? If most of your patients use insurance or if you have a lot of patients, a clearinghouse can make your submission process more efficient. That efficiency saves you time and allows you to provide a higher quality of care to the people you treat. If you have a smaller claim volume, it might not make economic sense to use a clearinghouse.

- Do you bill electronically? Clearinghouses work with electronic billing and record-keeping programs for a streamlined process.

- Are claim errors an issue at your practice? Mistakes happen. If they seem to happen frequently at your practice, particularly with claims, a clearinghouse can help to prevent errors that lead to claim denials and rejections. Minimizing errors also means your team can spend less time on hold with payers and more time providing excellent care.

- How long do you typically wait for reimbursement? Cash flow concerns can affect a provider's ability to provide the best care and service to its patients. If you usually wait weeks for insurance reimbursement, the waiting period can affect your bottom line and make it difficult for your practice to pay bills. If you're tired of long waits or can't afford to wait a long time for a payer to reimburse you, a clearinghouse might be the way to go.

What to Look For When Choosing a Clearing House

When you're shopping around for a medical clearinghouse to work with, you should look for various features. Some qualities affect your liability concerning patient confidentiality, while others affect how beneficial the clearinghouse is for your practice. Some things to pay attention to include:

HIPAA-Compliance and Accreditation

Patient confidentiality should be a key concern at your practice. It's vital the clearinghouse you work with complies with all regulations regarding the electronic transmission of patient information. If the clearinghouse doesn't comply with privacy laws or if a breach occurs, it or your practice can be responsible for fines.

One way to verify a clearinghouse's track record when it comes to compliance is to look for an organization accredited by the Electronic Healthcare Network Accreditation Commission (EHNAC). EHNAC accreditation means a clearinghouse has met certain criteria and achieved a passing score of at least 85%.

Extensive Payer Lists

Ideally, the clearinghouse you choose will have the insurances your practice accepts on its payer list. Often, smaller, regionally operated clearinghouses charge less than national clearinghouses but don't have extensive payer lists. If the payers you work with aren't on the clearinghouse's list, the claims submission and payment process become more complex, meaning it can take longer to get paid. Your practice might be better off choosing a national clearinghouse with a comprehensive payer list rather than a smaller company.

Ease of Use

The clearinghouse's program should be easy to navigate and understand how to use. The control panel should let you see at a glance which claims you've filed and which ones have been rejected or accepted. Ideally, the control panel will make it easy to see which claims have been paid, too.

Customer Support

If you have an issue with the clearinghouse, what are your options? Check out the customer support the organization offers before you partner with it. Find out when help is available — like 24 hours a day or only during standard business hours — and the options for getting in touch with someone. Also, find out the typical response time if there is an issue. Ideally, the customer support team will get back to you in 24 hours.

Consistency and Accountability with 835s

Remittance advice, or an 835, lets you know that an electronic payment has been submitted. Ideally, the clearinghouse will send remittance advice at the same time the payer is sending payment. Getting an 835 weeks after the payment can cause confusion or lead to payments that aren't recorded properly.

Claims Response and Analysis

Once you submit claims to the clearinghouse, how long do scrubbing and submission take? Ideally, the process will start immediately and finish not long after. If there's a delay, that delays your payment. A delay can also mean you need to wait another day or two to fix any claim issues.

If a payer rejects a claim from the clearinghouse, does the organization help your practice understand the reason behind the rejection? If, during the scrubbing process, the clearinghouse discovers an issue, does it provide a detailed description of what went wrong? Knowing why your claims are denied helps you avoid similar errors going forward.

Flexibility and Compatibility

Ask the clearinghouse what sort of contract options it offers. You might not want to sign a year or multi-year contract right away and might prefer the flexibility of a month-to-month agreement.

Your clearinghouse should also be compatible with the EHR and medical billing software your practice uses. If the two aren't compatible, a disconnect can occur, and one organization might blame the other for any issues that come up. Working with compatible software also streamlines the process of getting paid.

Learn More About EHR Software Today

An EHR software program that integrates with your clearinghouse of choice allows you to provide consistent, quality care to your behavioral health patients. ICANotes is designed with the specific needs of behavioral and mental healthcare providers in mind. Browse our blog for more information and resources to help you improve your practice and streamline your organization's efficiency.

To see how our software works, schedule a live demonstration today.

Related Posts

Top 6 Benefits of EHR Software for Psychologists and Psychiatrists

What Is a BillFlash Statement?

Billing Pitfalls for Mental Health Clinicians

What Is the Difference Between a Clearinghouse Rejection and a Payer Denial?

Mental & Behavioral Healthcare Billing: How to Maximize Your Reimbursement Rate